Tailoring your financial model for success at every stage of your journey

SPEED. This is the one competitive advantage, startups have over established incumbents.

Google has been working on generative AI since 2008 and created not one but two separate divisions to focus on artificial intelligence. One of these successfully developed Language Model for Dialogue Applications, LaMDA, the technology underpinning chat bots. Despite all of these, OpenAI a much smaller startup and not Google that is the market leader in generative AI with its phenomenally successful ChatGPT app and plugins.

One of the worst things any founder can do to themselves is to give up this speed advantage and get sucked up in analysis-paralysis. Over the past two-and-a-half years, the one thing I have emphasised to founders is: your financial model cannot be too simple but it can be too complex. I’ve seen founders develop complex business plans and financial models BEFORE they even launch or validate they have a business.

It’s not all founders’ fault, there are loads of consultants and advisers who make a living off convincing founders to spend thousands of dollars on business plans and financial models that end up in the trash can – at times together with the startup. Financial models and planning are important but the level of detail must match the objective at that stage for the startup.

Let’s explore what your objective should be at every stage of your startup journey and how your financial model can help you achieve those different objectives.

Idea Stage

Objective: Idea Validation

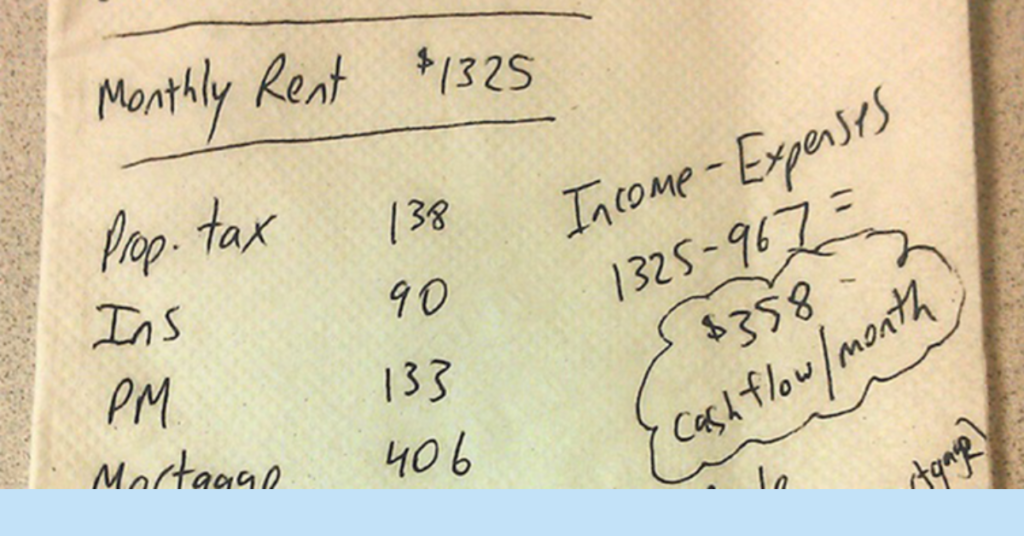

Type of Financial Model: Back-of-the-Napkin Model

If your financial model at the idea stage is more complex than this scribbled notes, you’re NGMI! That’s extreme and a joke but really, at the very beginning, your financial model is more like a sketch than a detailed plan. You’ll have a rough idea of your costs, potential revenue, and growth prospects. During this stage, it’s all about being agile and flexible – don’t stress too much about accuracy. The key objective here is to gauge the feasibility of your idea and identify the key drivers of your business.

Pre-Seed Stage

Business Objective: Idea Validation

Type of Financial Model: The Lean and Mean Model

Once your idea starts taking shape, you’ll need to create a more comprehensive financial model. At this stage, focus on your most crucial assumptions, like your customer acquisition costs, pricing strategy, and revenue projections. Remember, investors want to see that you’re thinking strategically about your finances. The primary objective during this stage is to validate your business model and communicate your vision to investors in order to raise funds.

For instance, Slack’s pre-seed pitch deck emphasized their product’s potential to change the way teams communicate, which helped them secure early investments.

Seed Stage:

Business Objective: Identify scalable revenue streams

Type of Financial Model: The Growth-Driven Model

As you start acquiring customers and generating revenue, it’s time to refine your financial model. You’ll need to track key performance indicators (KPIs) and financial metrics, like churn rate, customer lifetime value (LTV), and burn rate. The main goal at this stage is to demonstrate your startup’s growth potential and attract further investments.

Mailchimp started as a side project but grew steadily by focusing on its core financial metrics, eventually becoming a billion-dollar company without external funding.

Growth Stage: The Scaling Model

Now, it’s time to scale! Your financial model should reflect your startup’s growth strategy, whether that’s expanding into new markets, launching new products, or acquiring other businesses. The objective here is to maximize the return on investment (ROI) for your shareholders and ensure the long-term sustainability of your business.

Your financial model should help you manage your cashflow very tightly. Most startups at this stage are making money but also burning through cash possibly at an astronomical rate. It’s very common to see startups run out of cash “suddenly” and then shut down even though they’re growing.

One of the most prominent stories of how a financial model saved a company is that of Paypal as told in The Founders by Jimmy Soni. When they were still a small startup, they were losing millions of dollars a month but didn’t know why until their then CFO and now Sequioa Head built a bottoms-up financial model. They were then able to understand and fix their unit economics.

Exit Stage: The Valuation Model

Finally, as you prepare for an exit, you’ll need a financial model that showcases the value you’ve created for your stakeholders. You’ll be focused on optimizing your profit margins, demonstrating steady growth, and highlighting your company’s strategic advantages. The primary goal at this stage is to maximize your startup’s valuation during an acquisition or IPO.

So there you have it! As your startup grows, your financial model will evolve to reflect new challenges and opportunities. Remember, the journey is just as important as the destination – so keep learning, stay adaptable, and enjoy the ride!

Get the Help You Need

As you grow and your financial model needs become complex, it becomes difficult and arguably impossible for the founders to focus on the model. If you’re well founded, it’s worth hiring a full time corporate finance professional to focus on your model. For later stage startups who are still conscious of costs, it’s worth considering part-time (fractional) professionals which is easier than ever to hire with platform like Fintalent, an M&A and PE staffing platform.