How to use your financial model to sell your vision and build successful businesses

Terrifying. Anxiety. Painful

These are some of the most common words founders that attend our “Demystifying Financial Modelling for Startups” sessions use to describe how financial modelling makes them feel. But this should not be the case especially for early-stage founders.

Yes, financial modelling can be complex and justifiably so. A project in mergers and acquisitions or project finance with a mix of debt and equity will be complex. But for a pre-seed, pre-revenue startup? Their financial model should be super simple and focused on the story rather than intricate accounting and corporate finance details.

What is a Financial Model

When most founders hear financial model or projections, they seize up completely as what comes to mind is a complex, multi-worksheet document. It’s also not helpful that there are many misconceptions in startup land and conflicting advice on what is a financial model. Quite simply, a financial model is a numerical document predicting (projecting) future cashflows based on a set of assumptions. As such any document that includes these projections is a financial model.

At pre-seed and seed venture stage, the key purpose of financial models is communication (by the founder) and decision-making (by investors). One of the biggest mistakes founders make is that they over complicate financial models and get drowned in the details. We can blame all the consultants who want to make money off founders and as such encourage them to build complex models.

The three financial statements – profit and loss, cashflow statement and balance sheet – constitute a standard financial model. However for startups, a complex 3-statement model isn’t often required and emphasis should be on other methods of communicating with investors.

What do Investors Want to See re: Financial Models

There are other use cases for financial models apart from fundraising – that said, the most common trigger for founders building financial models is related to fundraising. A typical founder journey re: financial modelling and fundraising is

- Pay a consultant £3,000+ to build a detailed financial model

- 1 to 2 months later the consultant delivers a detailed 10-worksheet financial model

- Founder does not understand the model but sends it to investors anyway

- Investor takes a look and it makes no sense at all. If founder is lucky, they receive feedback from investor otherwise it’s crickets

- Founder realises they need something simpler they can understand and confidently present

So let’s learn from other’s expensive mistakes and start from stage 5 instead. So what exactly do investors want to see?

What are your unit economics?

As a neutral observer in the audience at startup pitches, demo days or even shark tank / dragon’s den, it’s painful to see founders start to stammer when this question comes up. It’s the first, basic question every investor or judge is bound to ask if it’s not already answered. As a founder, you need to understand your unit economics and be ready to answer the questions. Or preferably provide the answers before you’re asked.

Is this a venture scale business? Or a pure impact focused one?

This is a question every founder should ask themselves BEFORE they start pitching to investors. It’s not an easy question because it’s also not binary but a continuum in between pure impact and pure high-growth, scalable venture outcome.

For venture capital firms (VCs), the main (only?) reason they invest is because a startup has the potential to “return the fund”. That is the business can grow in such a way that they can 100x their returns in 5 to 7 years. Roughly this means a minimum revenue potential of £100 million for the startup.

On the other hand, there are investors who don’t care at all about the financial returns. For them, success means making the world a better place. And then there are loads of grey in between these two extreme outcomes. As a founder, it is your job to accurately determine what the potential outcome is for your business and confidently communicate this in your pitch deck, financial model and other business documents.

Valuation, dilution, cap table and other ancillary financial topics?

Valuation for early-stage startups is a complex topic which we have covered here. In short, your financial model has next to no bearing on how you are valued. So don’t go forking out thousands of pounds for a valuation document. That’s just not how it is done.

Bringing it all together

Today, the pitch deck (at times a teaser) is the first document investors go through to evaluate startups. According to details from Docsend, investors spend aon average 3:20 (three minutes and twenty seconds) on a full pitch deck.

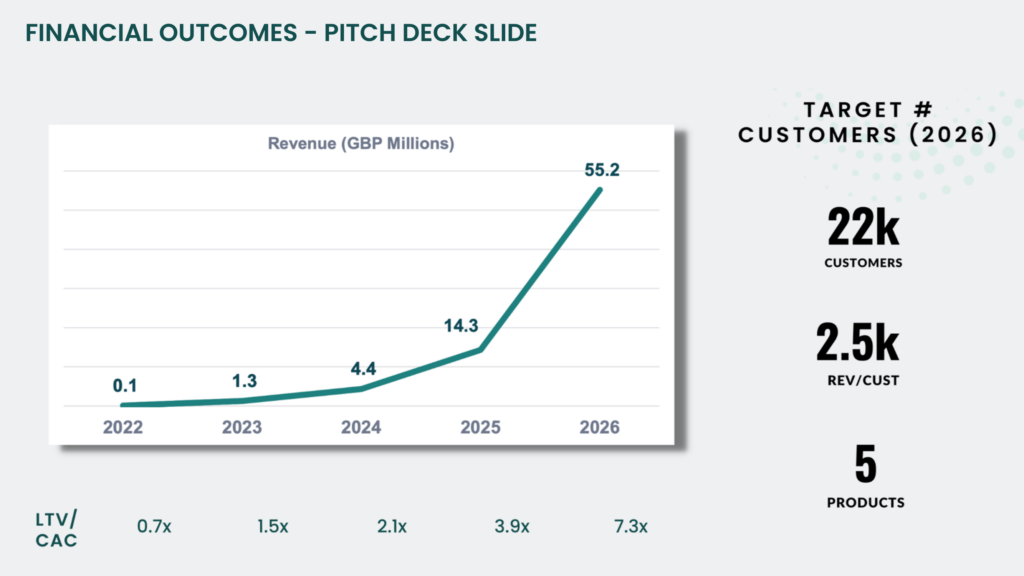

With this in mind, a pitch deck should be simple and the key message easy to consume. Particularly the financial slide and as such the sample below captures the three elements we spoke about earlier. If you were an investor, what would be the key message you’d take from this slide?

Hopefully it would be what the founder sought to communicate which is

- I am building a high-growth startup which offers you the opportunity to 100x your investment (the hockey stick chart)

- I understand what the key drivers of shooting for this venture scale outcome are (the assumptions to the right of the screen)

- I understand my unit economics and are focused on these as I build (LTV/CAC at the bottom)

Simplify your financial modelling and fundraising with Caena

FAQs

- Should I summarise my financial model in a table in pitch deck?

- No, please don’t. Your pitch deck should be simple and focus on what investors can consume in <30 seconds they typically spend per slide

- I finally have a detailed model, when should I send it out to prospective investors

- When they explicitly ask “I need to see a full financial model”, at the DD stage typically.

- So a process may look like this

- Send out pitch teaser (no financials included) to your target audience to gauge interest

- Meeting / live pitch: pitch deck will include a financials slide as described above. Be prepared to answer any questions that may come your way

- DD process: you may need a financial model (not all the time)

- So when you’re starting your fundraise, all you need is a simple model where you can extract your unit economics and a 5-year revenue chart

- Should I DIY my model or hire a consultant or CFO

- At pre-seed and seed, you’re much better off building something simple by yourself. If you get to DD stage and definitely need a more complex document then hire someone. But ensure they don’t overcomplicate your model. Early-stage investors are not fans of 10-slide financial models