How to Build a Simple Startup Financial Model for Impact Funding Applications

For founders who are new to fundraising from impact investors, the importance these investors place on financial models and numbers can be a rude shock. So why do impact investors place such a relatively high emphasis on financial projections compared to other investors especially VCs?

The main reason is risk / return appetite. VCs invest based on the power law principle where they expect to lose majority of their investors but make exponential returns from a tiny minority. For instance, most VCs would be fine if 5 out of 10 startups in their portfolio fail completely as long as 1 out of the ten can “return the fund.” That is provide a return of ~100x or so which more than makes up for all the money lost. The search for this mega returns means VCs invest mostly in the founder or team rather than based on the business model or opportunity.

Impact investors on the other hand want as many of their portfolio companies to remain as going concerns and achieve the impact promised. As such, they are not as bothered with returns as VCs are. This “double bottom-line” requirement means impact investors care a lot about financially sustainable models.

What Questions Should Your Model Answer?

Your financial model has to strike a fine balance between demonstrating your potential for financial return and the social or environmental impact your startup could have. The more clearly and convincingly you can answer these questions in your financial model, the more likely you are to secure impact investment.

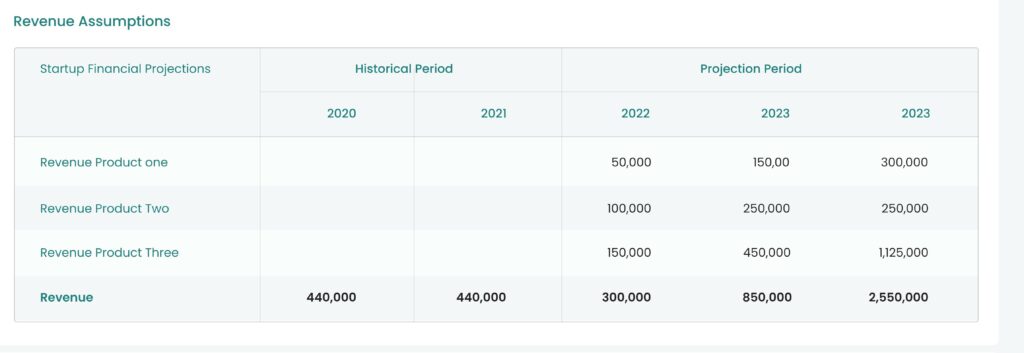

- How do you make money? Impact investors need to understand your revenue model. You have to clearly define your product or service, your target market, and your pricing strategy. Articulate how these elements coalesce to create a reliable stream of income. Business models include subscriptions as a service (SaaS), marketplaces, advertising and transactional.

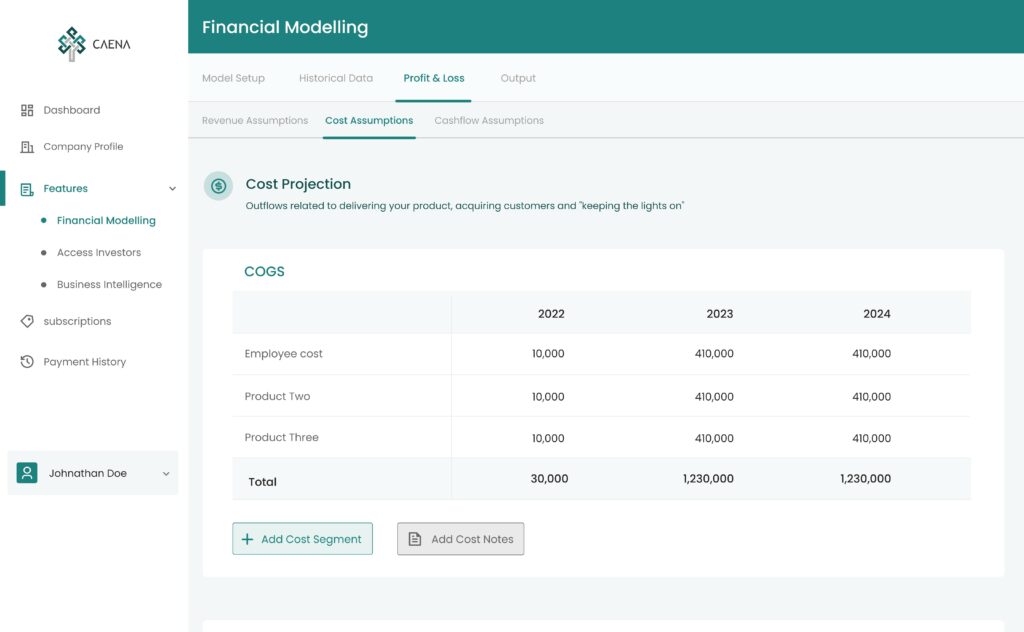

- What expenses are required to support revenue generation? This is also a test of how well you understand the key drivers of your business. Good entrepreneurs will be able to make decent assumptions around the investments in product development, marketing, sales, operations, capital expenditure and so on that are required to support the projected revenue growth. If you have been in operation for more than a year then include historical revenues and costs in your model in addition to projections.

- How much capital will you need to raise? Most startups will have a funding gap in the first few years. This will require external funding until the business turns cashflow positive. Detail how much capital you’ll need to raise from investors to achieve your outlined business and impact objectives. Your ask should align with your financial projections and demonstrate a clear pathway to creating a return on investment for the impact investors.

- How does your business create social/environmental impact? Remember that for these investors, it’s not all about financial returns. Detail how your business operations or your product/service creates a positive impact. Clearly define the Key Performance Indicators (KPIs) you use to measure your impact. Businesses with impact KPIs that seamlessly flow from financial KPIs stand a better chance as it means impact is integral to the business and not an afterthought.

- What is the expected financial return? Impact investors are still investors, and they want to know the potential return on their investment. Provide clear, realistic projections on expected revenue growth, profitability, and cash flows. Investors will also be deducing potential exit options based on these financial outcomes

How to Build Out a Simple Impact Financial Model

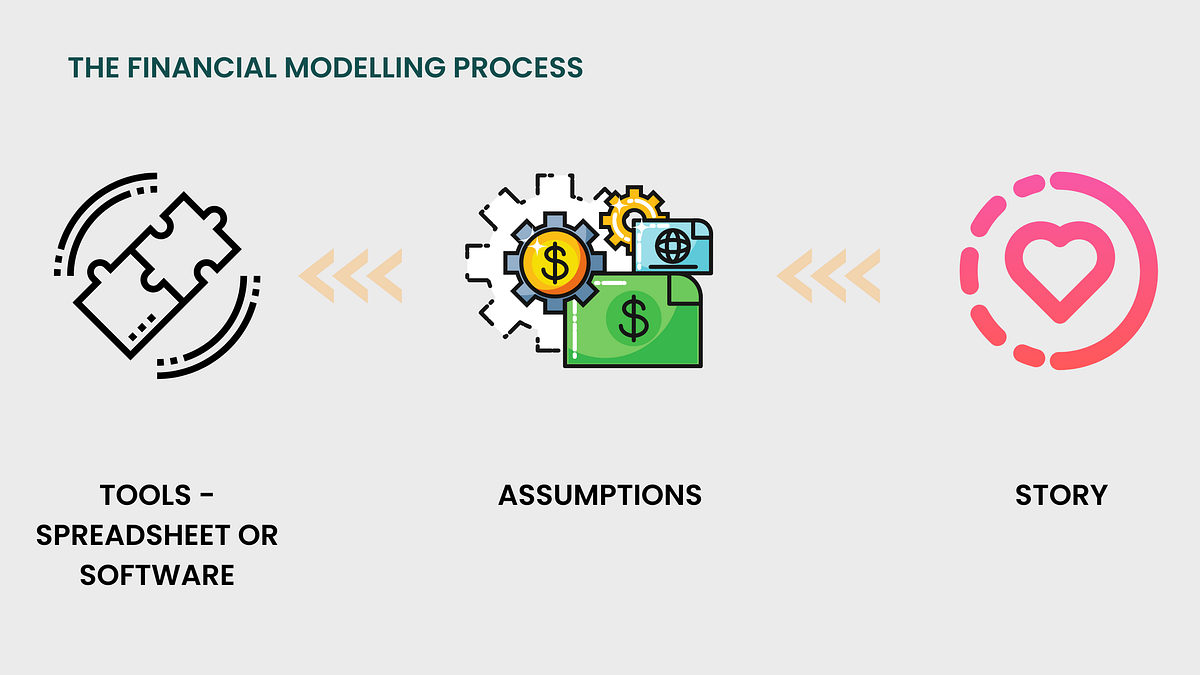

Typically, founders think of financial models in terms of (i) consultants or tools required to build models (ii) financial modelling assumptions (iii) conclusions.

A better process we recommend is to turn this process on its head and start with the outcome — what message are you trying to pass across? WHAT’S YOUR STORY? As we mentioned earlier, impact investors are concerned about broad outcomes combining financial and non-financial outcomes. One trick is to check out impact reports published by investors you’re presenting to. Your story and long-term outcome will have to align with the metrics published by the investors.

The second step is to identify the revenue, cost and cashflow assumptions that need to be in place for the outcome in step 1 to be realised. Two concerns we hear from startup founders are (i) where do I find assumptions and (ii) how do I know my assumptions make sense. Your business plan is the key input into your financial model. This can be supplemented with additional market research, customer surveys, industry benchmarking and data from running your business. For a deeper dive into financial modelling assumptions, read more here.

The last step is to make a choice on the tools to help you bring your financial model to life. There are two broad options -do it yourself (DIY) or hire someone to build for you.

Do it Yourself (DIY) is the most cost-effective method and suggested approach for early-stage founders. The benefits are that you are forced both keep things simple and by building yourself, you understand fully what you’re presenting. However, DIY can be time-consuming and challenging if you’re not familiar with financial modeling best practices. Furthermore spreadsheets can be very, very complex to navigate.

It’s this problem Caena solves with our fully automated financial modelling tool. In less than 30 minutes, you get a simple yet detailed set of financial projections, charts and metrics. Ready for investor presentations and pitch decks.

The other option is to hire consultants or in-house experts to work on your financial model. This is the suggested option for latter stage startups and / or those with complex operations and business models. Experts bring their experience of working with many different businesses and can offer personalized advice tailored to your specific needs. However, this can be an expensive option and may not provide the same level of understanding or ownership as building the model yourself.

Remember, whatever path you choose, it’s essential to stay involved and understand the underlying assumptions and calculations. This will enable you to confidently present and defend your model in front of potential investors.