For Venture-Backed Startups, Slowing Growth Should Not Mean Shutting Down

Just 12 months ago, Susan was on top of the world and it felt like nothing could go wrong. She and her HapMedAI team were celebrating the fast-growing healthtech startup’s successful closing of a $15 million Series A round. Although the food and atmosphere in the swanky New York restaurant were top notch, she found it hard to be present as she was already thinking about expanding the team, growing revenue and a Series B within 12 – 24 months.

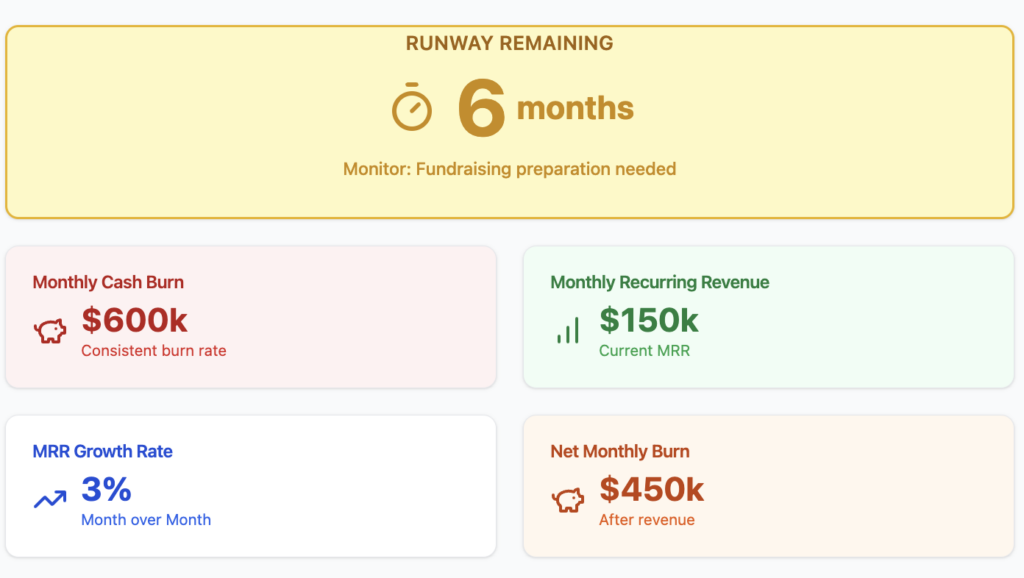

Fast forward to today and everything that could go wrong had definitely gone wrong. The changing macroeconomic conditions, especially rising interest rates, had severely impacted HapMedAI and its customers. At the time of the Series A raise, their financial model projected annual recurring revenue (ARR) to grow from $1.2 million in 2023 to $3 million in 2024. Heading into the last month of the year, the team were hustling to close the last few loose ends that if achieved would get revenue to $1.7 million, a far cry from investor expectations.

Over the past 12 months, Susan has noticed a palpable shift in attitude from her investors. In the weeks leading up to the Series A and for the first few months thereafter, she always received instant responses to text messages and emails from every single one of her investors. However, slowly and steadily, each of her investors had retreated till the best of them would respond to messages two weeks at the earliest. What Susan didn’t know is that her investors had silently written her off as a Zombie startup. A humiliating classification for any startup with high ambitions and one which is potentially a death sentence.

Why Do VCs Give Up on Zombie Startups?

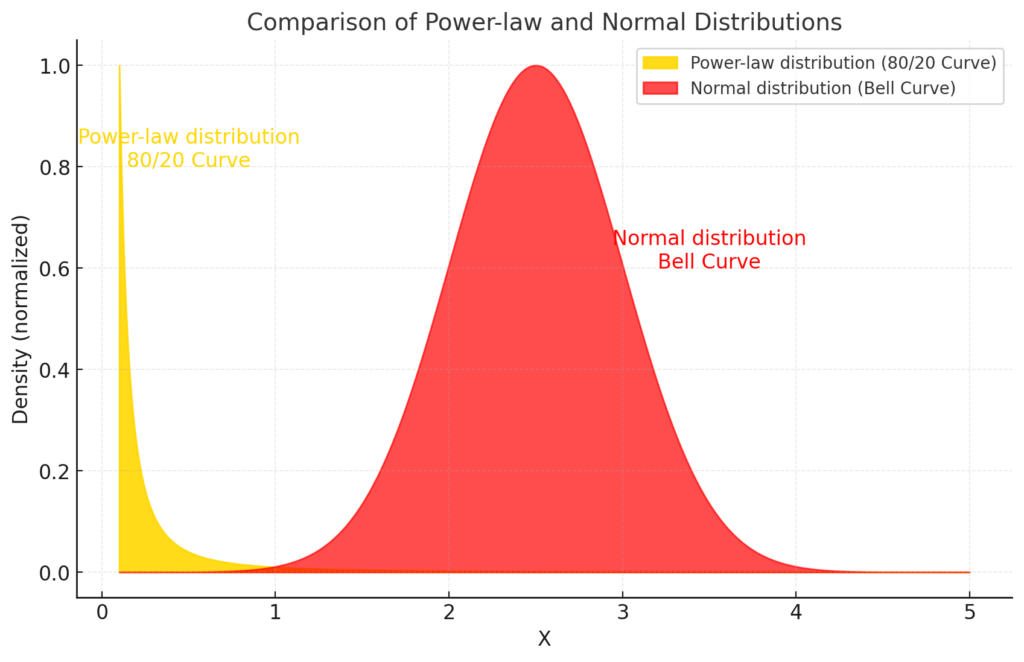

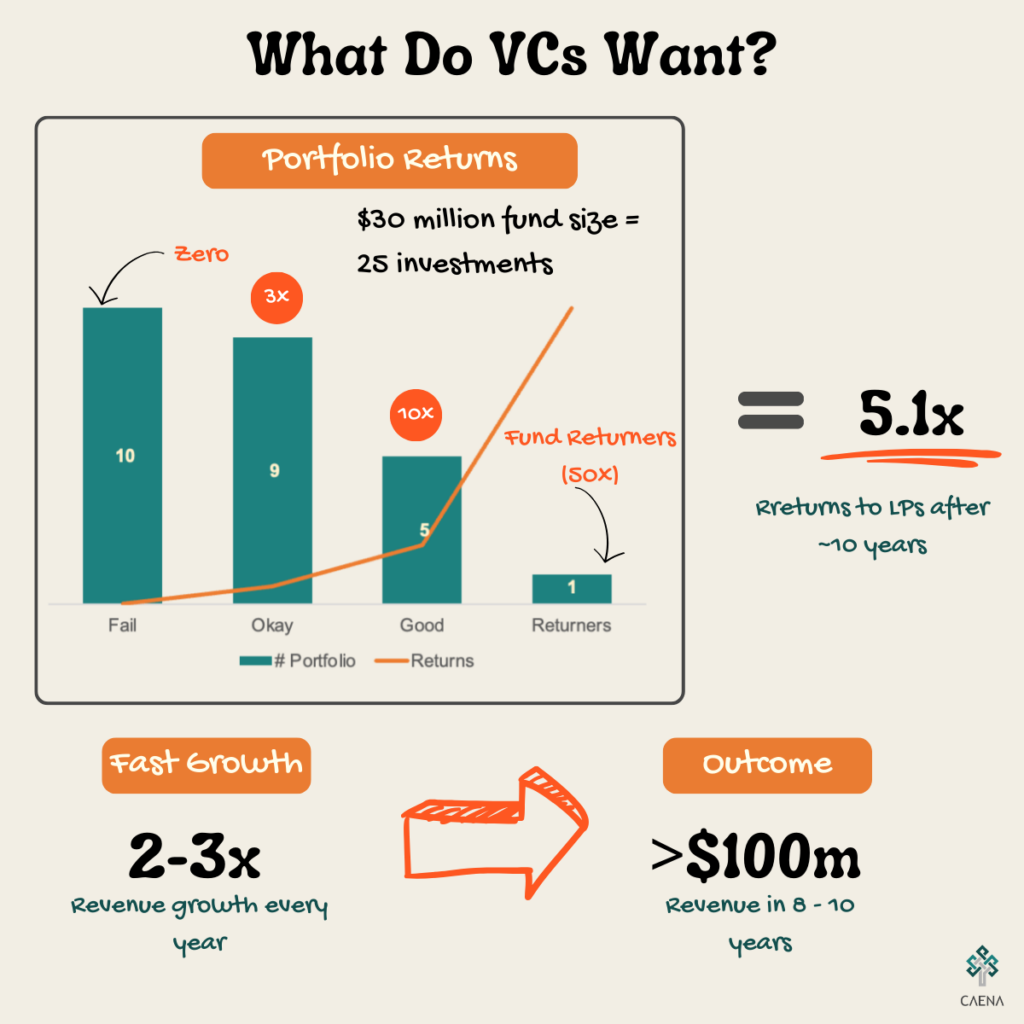

Two words: “Power Law,” an adaptation of the Pareto Principle which guides most venture capital investments. Returns in the most successful funds have been found to follow a power law distribution rather than a normal distribution.

VCs invest under the assumption that one super successful startup in a portfolio of say twenty, will return more to a fund than all others combined. As such, they seek to optimise returns from those most likely to be outliers or ‘fund returners’ – achieving upwards of 50x initial investment. It’s the main reason why VCs reject so many startups who think they are good businesses but the VCs don’t believe they can scale exponentially enough to return their fund – a.k.a. venture scale.

The problem is that this theoretical returns distribution holds true in reality for only a small percentage of VC funds. In reality, 75% of VC funds don’t return up to 2.5x investment returns (meaning LPs are better off investing in S&P 500) and the bottom 25% don’t even return 1.0x invested capital. This is because it is incredibly rare to pick the 50x outliers that are essential to a successful power law strategy. This is according to research by Cambridge Associates, which concludes that even the top VCs have a 2.5% chance of picking these outliers.

Holding onto the Power Law as a default strategy is like expecting all startups to pursue a go-to-market strategy like OpenAI did with their 10bn war chest and achieve the same 100 million users in 3 months’ trajectory. As unfeasible as the OpenAI trajectory is for the average startup founder in Lagos, London or even Los Angeles, so it is for the average VC pursuing a Power Law approach. Unfortunately, there’s little evidence of many VCs bucking the all-or-nothing strategy. The two notable exceptions are Indie VC led by Bryce Roberts and Calm Fund by Tyler Tringas. Both funds focus on “one and done” approach, backing startups which intend to raise just one round to get them to profitability.

Chances are HapMedAI has a cap table filled entirely with angels and traditional VCs pursuing the more common all-or-nothing approach. So it’s understandable that the VCs are either unwilling or unable to provide ongoing support to help the team weather the storm.

VC- Backed Startup Shutdowns: Outcome of Lack of Support?

3,200 venture-backed U.S. startups went out of business in 2023 according to the New York Times. These startups collectively raised over $27 billion in venture funding before packing up. By all indications, 2024 will be as bad. Data from Carta indicates that as at 1Q 2024, there was a 58% year on year increase in startup shutdowns. These failures are a direct consequence of the boom or bust approach that pursuing venture scale necessitates. It’s understandable when startups that have no real value or customers shutdown, what’s appalling is startups that have potential to exist as stable, sustainable business shutting down because they are no longer venture scale candidates.

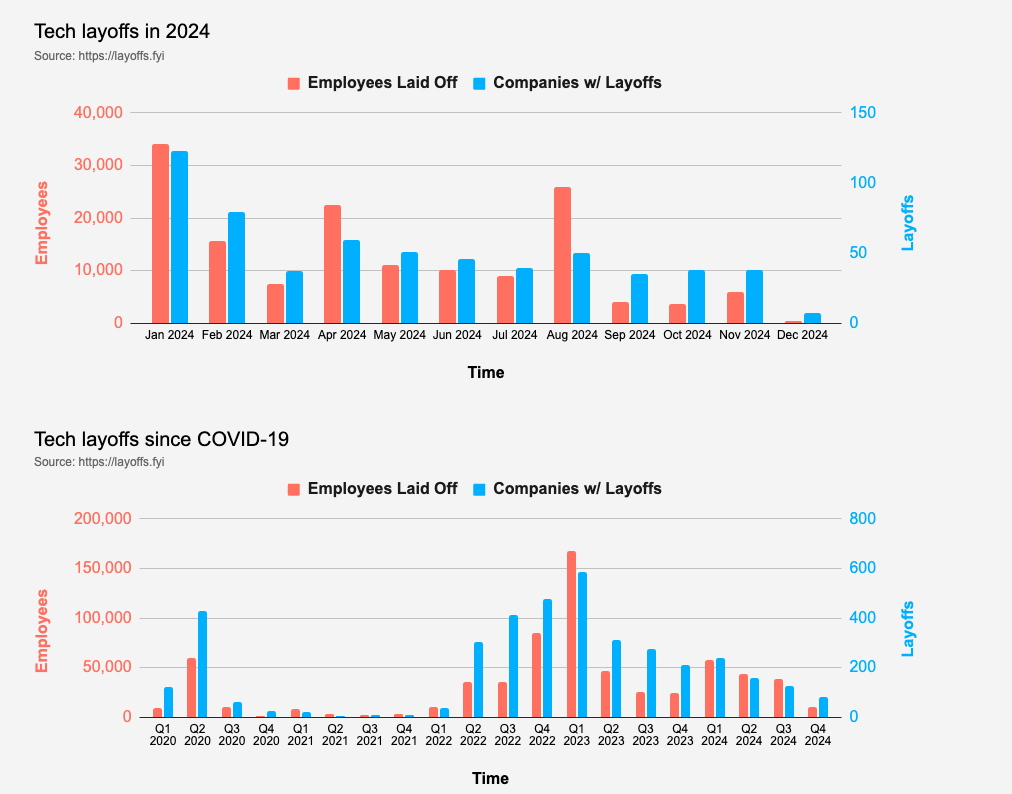

The implications of these shutdowns are multifaceted, with by far the largest impact being that to employees and investors. The startup layoff tracking site Layoffs.fyi reports 526 tech companies with almost 150,000 employees laid off in 2024 alone. The good news is that 2024 is on pace to be a better year than 2023 when almost 1,200 tech companies combined to lay off over 250,000 employees.

There are many reasons why the default solution to slowing growth and attendant inability to raise further funding is a complete shutdown. Each startup shutdown is unique but some of the common factors include:

- Investor expectations: they signed up for >10x returns and would consider it not worth their while to commit time and money into rescuing invested funds

- Founder motivations: many founders would rather go take another shot at a big win than try to rescue one that is obvious won’t become a unicorn

- Existing structure: switching from a fast-growth mentality to a more sustainable, profit-minded startup isn’t exactly easy

That’s why the rare step by Pitch, a Berlin based startup to return investor capital and “get off the treadmill” is commendable. Founded in 2018 by well credentialed serial entrepreneurs, Berlin-based Pitch raised a total of $130 million dollars in funding by late 2024. In January 2024, citing the unrealistic, “hyper-growth company expectations”, Pitch decided to abandon the venture path and switch to bootstrapping instead. This involved laying off 2/3rds of employees including the founder/CEO, returning bulk of unspent funding to investors, focus on attaining profitability and “resetting” the cap table such that founders and current employees would own 80% of the company going forward. It remains to be seen how this remarkable and brave move plays out.

What are the Alternatives to Venture Hypergrowth and Creation of Zombie Startups?

Although the default unicorn-hunting venture capital model of backing a few hypergrowth, high risk startups isn’t going anywhere, it’s obvious this model works only for a very few. Currently, too many founders and VCs fail disastrously while pursuing this strategy. There is a need for an alternative model that compliments this approach and works better for LPs, GPs, founders, employees and other stakeholders.

For instance, the failure rate of VCs could be mitigated by pursuing a more sustainable portfolio optimisation approach rather than concentrated bets in a few startups. What if investors pursued a more sustainable and balanced approach instead of the traditional Power Law approach?

The two strategies in the image above result in the same targeted returns profile of 3.2x. The success of the Power Law strategy on the left depends on finding that one outlier that delivers all of the results of the fund, the fund leaves a long tail of destruction (zombie startups) in it’s wake. A normally distributed strategy on the other hand achieves success by limiting risk across the portfolio, potentially reducing complete failures from 55% to 25% and spreading success across the rest of the portfolio.

The change of strategy from a venture path to another option can either be initiated by VCs or management team. In either case, it requires both parties to be in sync as to what the best option is for the company and its stakeholders. For Pitch, which we discussed earlier, it was a return of capital and switch to bootstrapping. We’ve seen other zombie startups choose other options such as a merger, sale to a bigger company or even to continue on the venture path. The factors to be considered are many but some of the most important are:

- Revenue: is revenue at a decent level for funds raised and stage of business? Is revenue growing at least 2.0x year-on-year up to Series B?

- Profitability: is there a path to cash flow profitability? Are unit economics positive?

- Team: is the founding team still energised to continue to execute for many years till exit? Are existing investors and other stakeholders fully supportive?

The VC-Backed Startup Health Check above represents the key decision points that companies like HapMedAI face when evaluating their path forward. While the framework is clear, making these assessments objectively and implementing the resulting decisions requires specialised expertise – expertise that most startups and VCs don’t have in-house.

If your startup is at a crossroads similar to Susan and HapMedAI, the first critical step is to avoid the mistake that sinks many promising startups – denial. Confronting challenges early and honestly with your management team dramatically increases your chances of finding a viable path forward. We’re offering a limited number of free initial health check assessments for Series A+ startups to help teams evaluate their options objectively. Get in touch to learn if your company qualifies.