The venture world is currently undergoing a correction after a hype-fuelled 10-year bubble. Startups are packing up in record numbers due to inadequate revenue and inability to raise additional funding.

What has been will be again, what has been done will be done again; there is nothing new under the sun – The Hold Book

Two (or three depending on who’s counting) bubbles ago, there was WebVan. A darling of Silicon Valley, they capitalised on the e-commerce frenzy to launch a glitzy online grocery delivery business right in the early days of the internet. Investors flocked to them, they raised millions of dollars from top VCs and a massive US$375 million in a 1999 IPO.

Flush with IPO cash, WebVan invested heavily in expensive infrastructure, including high-tech warehouses and a fleet of delivery trucks. They expanded rapidly, trying to reach as many cities as possible to satisfy their investors. Less than two years after their IPO, WebVan filed for bankruptcy having lost over US$800 million.

Every startup failure is unique but there are a few common financial missteps that can sink any company.

Misstep1: Ignoring Unit Economics

Like WebVan 20 years ago, many darlings and (exes) of the tech world today such as Uber and WeWork are massive but are money losing entities at scale. What worked for them to scale so big won’t work for you today. You must focus on your unit economics. Very simply, if your losses widen as you serve more customers then your unit economics don’t work.

Unit Economics refers to the direct revenues and costs associated with a particular business model expressed on a per unit basis. For a startup, the unit could be a single product, service, or customer, depending on the business model. It’s a crucial metric to understand because it helps determine whether a business can be profitable. If the cost to acquire a customer (CAC) or produce a product exceeds the revenue that customer or product brings in, the startup’s business model could be fundamentally flawed.

✅ Continually Monitor and Update: Unit economics is not a one-time calculation. It should be continually monitored and updated as your business scales and evolves. See more details on unit economics for every startup stage here.

❌ Don’t Make Assumptions Without Testing: Assumptions about costs, customer acquisition, and customer lifetime value should be tested and validated. Incorrect assumptions can lead to a distorted understanding of unit economics.

Misstep 2: Spend Like Google

Team outings, grand offices, on-site masseuse, free food, expensive software, startup exhibitions, consultants… the list of items to blow money on is endless. Unfortunately, 1 in 1,000 of startups can generate the revenue to justify expenses that are not directly tied to the ONLY two things that matter – building stuff and selling stuff. Google was and is making enough money to afford the benefits, you aren’t so don’t ruin yourself trying to copy without context.

If you are an early-stage startup (pre-series A or less than $100k monthly revenue), forget about vanity metrics and frivolous expenses. When expenses on non-essentials start to pile up, they can have a substantial impact on a company’s bottom line, especially in the delicate early stages. One approach that I’ve seen work is to cancel EVERYTHING and then gradually add back pure essentials.

✅Create a Culture of Responsibility: Encourage employees to treat the company’s money as their own. This sense of ownership can lead to more thoughtful spending decisions

❌ Don’t Forget to Re-evaluate Regularly: As the business grows, its needs and what might be considered frivolous can change. Regular re-evaluation ensures that the company is always operating efficiently without unnecessary costs.

Misstep 3: Growth Without Revenue

In the heady days of 2021 – 2022, Fast, A San Francisco based startup raised over $120 million to “disrupt” the online payments space with one-click checkout. The company burnt $10 million a month in 2021 to return a paltry $600,000 in annual revenues. By April 2022, they called it a day. Talk about Burn Money Fast!

Startups often fall into the trap of pursuing growth for growth’s sake, without a clear path to monetisation enough to justify the money spent on growth. The thought process behind this is often driven by a “land grab” mentality, or the idea that acquiring market share is more important than generating revenue in the early stages. While this strategy might work for certain types of businesses in specific sectors, it can lead to ruin for many startups.

✅Develop a Monetization Strategy: Before embarking on a growth campaign, it’s essential to have a clear monetization strategy in place. This doesn’t mean you have to monetize from day one, but you should have a clear plan on how you will generate revenue.

✅Experiment with Different Revenue Streams: Don’t put all your eggs in one basket. Try out different revenue streams and see what works best for your business.

❌ Don’t Assume More Users Equals More Revenue: It’s not always the case that more users equals more revenue. Sometimes, increasing your user base can lead to higher costs without a corresponding increase in revenue.

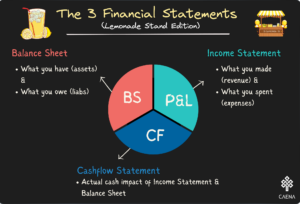

Misstep 4: Mistaking Revenue for Cashflow

Cash is the lifeblood of any startup. The phrase, “Cash is King” wasn’t coined without reason. If a startup doesn’t have a clear understanding of its cash inflows and outflows, it can quickly find itself in dire straits, regardless of the potential of the business idea or the size of its customer base. Positive cash flow ensures the business has enough to cover its operational costs and invest back into growth.

✅Manage Receivables and Payables Efficiently: Ensure you’re invoicing customers promptly and chasing up on late payments. Likewise, take advantage of payment terms offered by suppliers and avoid paying bills before you need to.

❌Don’t Ignore Cash Burn: Cash burn is the rate at which a company uses up its cash reserves or cash balance. Ignoring this can lead to insolvency, so it’s important to manage this carefully.

Misstep 5: Leverage

“We can fund you quickly and you don’t have to suffer any dilution unlike raising venture capital”

Oftentimes, when anything is too good to be true, it will always come back to bite you. While debt can be a useful tool for fueling growth, it can also lead to a startup’s downfall when mismanaged. Debt commitments come with regular repayments and interest charges, which can drain a startup’s cash flow and limit its financial flexibility. Furthermore, heavy debt burdens can make a startup less attractive to potential investors, who may be concerned about how these liabilities could affect future profitability

✅Maintain a Healthy Debt-Equity Ratio: Having a good balance between debt and equity can help ensure that you have enough cash on hand for operations, while also demonstrating financial stability to investors.

✅Borrow Strategically: Only take on debt to fund operations that can directly lead to increased cashflow. Borrowing for risky, long-term investments without adequate equity buffer or too early on your journey can be disastrous.

❌Don’t Ignore the Cost of Debt: Interest costs can add up quickly and eat into your profits. Always consider the cost of debt and look for the most cost-effective financing options.

If you need help with any strategic finance related issues, get in touch to book a consultation or check out our resources at Caena Academy