Why you should bootstrap rather than seeking venture funding at pre-seed stage and how to survive the pain of bootstrapping a startup to success

Bootstrapping a startup is painful, it’s expensive but it is worth it. Pre-seed funding is one of the most misleading concepts in venture capital and one of huge frustration for startup founders. The naming gives entrepreneurs the impression that all they need to attract institutional funding is to have a great idea (every founder’s idea is genius to them) and a killer pitch deck. In reality, funding to pre-product, pre-revenue companies is quite rare and depends on a lot of complex, unclear conditions.

It used to be that entrepreneurs would deploy their savings, then tap FFF – Friends, Foes and Fools – to bring their idea to market. Once a product is live and the business has paying customers, other options open up including bank funding and venture capital. Today, many pre-seed venture firms want to see some traction and possibly thousands of pounds in revenue. It is thus safer for founders to assume revenue generation as the key milestone for attracting institutional capital.

Pre-seed doesn’t mean idea stage. Pre-seed should still have traction, even if it’s small.

— Evan Stewart (@heyecs) May 14, 2022

Considering there are exceptions and some funds actually invest very early, bootstrapping – which we define loosely as absence of venture funding – is a better alternative for most founders for three main reasons.

1. Bootstrapping gives you the option to either go wild or go slow

The definition of a successful outcome for a startup is very varied and depends on the individual founders. It could be creating employment opportunities, steady income to the founders, paying dividends to initial backers, making the world a better place and lots more. For a venture backed startup, there are only two outcomes that count, an IPO or a large acquisition (greater than $1 billion). Nothing else counts.

Successfully building a venture scale company, as the latter option is referred to is incredibly difficult, very rare and very very demanding. This perhaps explains why VCs have to be selective, they are NOT evaluating whether your startup will be successful as you have defined it but strictly whether your idea will result in a nice exit for them. When a startup founder takes venture capital, that effectively means getting on the treadmill of fast growth, never ending rounds of fundraising and commitment to venture type returns. There’s no turning back.

Bootstrapping for as long as you can ensures that you retain the option – raising venture capital in year two or later in your journey means you are likely to know what you are getting into and how to deal with the pressure.

2. Bootstrapping means founders have more ownership and control

One big advantage of bootstrapping is that you retain control and ownership of your company. For the venture journey, there are several fundraising events over an average seven to ten year period from founding to exit. At each stage, investors typically take take 10-20% stake in exchange for capital invested. As such, it is not uncommon for founders to have very limited stake in their companies by the time the company is reaching maturity.

With bootstrapping, founders typically raise institutional capital later in the process and also from a position of strength. Mailchimp is one of the most famous examples of a successful bootstrap exit. After almost twenty years of organic growth with limited external capital, Mailchimp sold to Intuit in 2021 for $12 billion. At the point of exit, its co-founders owned 80% of the company meaning the sale netted them $5 billion each.

3. Fundraising is hugely time-consuming and distracts from execution and ability to demonstrate

The narrative in the tech world over the past 10 years has fuelled the perception that it is easy to raise funds. This has led many first time founders to focus on venture capital on day 1 rather than laying the groundwork for the business – writing business plans, building (basic) financial models, conducting market surveys and building a team.

However, the reality could not be more different. Less than 1% of companies receive venture capital financing at any stage in their company’s lifecycle. The percentage that receives funding in the first few months of their existence will surely be lower than this. Worse still, if you are not an in-network, tick-all-the-right-boxes founder the odds are much lower and you should be realistic about your chances.

VC investment breakdown:

— Allison Byers (@apbyers) May 11, 2022

👩 2% goes to women

👨🏾🦱1.2% goes to Black founders

✈️27% went outside CA, NY, MA

If you are in those stats, you need to know more mtgs ≠ $. Be realistic and consider other sources of capital.

Bootstrapping is by no means an easy option and there are a couple of factors to consider if you decide to pursue this path to building a world-class company.

1. Keep operating costs low

When bootstrapping, there is no option of expensive startup mech, large offices, fancy meals and all the glitz and glamour typically associated with startups. Revenue and external capital are largely out of your control but the one thing you control is costs – keep them low, lower your burn rate and extend runway. There are many tasks involved in setting up a business that may not be too expensive by themselves but all add up – setting up a website, creating a logo, building your basic financial models and so on. Fortunately, there are may DIY software tools that help with this, we put together a list which you can access here.

2. Seek out free external capital

Bootstrapping does not mean saying no to external capital, it just means being realistic and smart about how you pursue it. Beyond friends and family, government, private sector grants, accelerators and entrepreneurial programs are viable options as they focus on other non-return metrics unlike VCs. For instance, Cartier Women’s Initiative has supported entrepreneurs across the world with equity-free grants for over 15 years. The 2023 call for submissions opens on May 16 and for the first time, there is an all-gender category.

3. Consider debt financing

Debt is not often the first option entrepreneurs think of but with some traction especially decent revenue, it should be an option. Founders with significant equity in their business and a good team can often get favourable terms for a small business loan. And if the company does well, the debt can be paid off relatively quickly.

4. Focus on sales

Some entrepreneurs choose to bootstrap their businesses by selling products or services from the get-go. This can be a viable option for businesses with novel or innovative products, as they can often generate early buzz and sales.

5. Be a domain expert, build your financial model and own your numbers

One of the privileges of day 1, VC – backed startups is that they don’t really have to know what they are getting into. All that money buys time to make mistakes, course correct and possibly hire expensive executives to right the ship. Bootstrapped companies have no such luxuries, be sure you know the domain very well, build your financial model, do your research before you put your savings on the line.

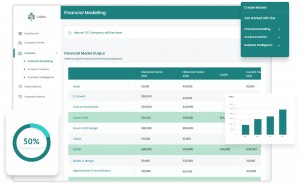

Financial modelling is often thought of as purely a fundraising exercise. Even then, because of its complexity, a lot of founders outsource this task when they need to build one. Over the past 15 months, with our radically simplified financial modelling tool, Caena has gone to great lengths to make financial modelling more accessible.

Join over 2,500 startups using our tool. Get started for free and also check out our investor matching tool which eliminates the need for sifting through several databases to find the right investors to reach out to.