In July last year, On, an enterprise AI startup, laid off all its estimated 60 staff members after allegedly discovering that $11 million in cash was missing. It was revealed that On’s CEO, Alex Beckman, had misled the board and management regarding the company’s financial status. The board discovered that an account which was supposed to contain $11 million only had 37 cents.

Following this discovery the company was left in a liquidity crisis, with just $550,000 in cash, and the board was forced to act quickly, hoping to stave off bankruptcy. Beckman was forced to resign under pressure, and the company laid off its entire workforce. On billed itself as an industry leading enterprise-grade conversational AI platform, trusted by the world’s leading brands in retail, sports, and media & entertainment and had raised over $35 million from investors. The company avoided filing for bankruptcy but is currently evaluating its options for the future after this financial debacle.

Why do investors get trapped into fraudulent startups?

The startup ecosystem is an exciting space with startups portraying themselves as the next big thing, showcasing impressive growth metrics and ambitious plans. But beneath the surface, financial records can be incomplete, inconsistent, or even deliberately misleading.

With approximately 90% of startups failing to survive beyond the first few years, investors who fail to dig deeper risk committing to ventures built on shaky foundations and facing significant financial losses. For tech startups, investors need to be even more diligent, as they have the highest rate of failure with 63% of tech startups failing!

Let’s look at another example of how an AI-founder, Joanna Smith-Griffin, was arrested for defrauding investors by misrepresenting revenue while fundraising. She founded AllHere Education in 2016, with the goal of using artificial intelligence to increase student and parent engagement and curb absenteeism.

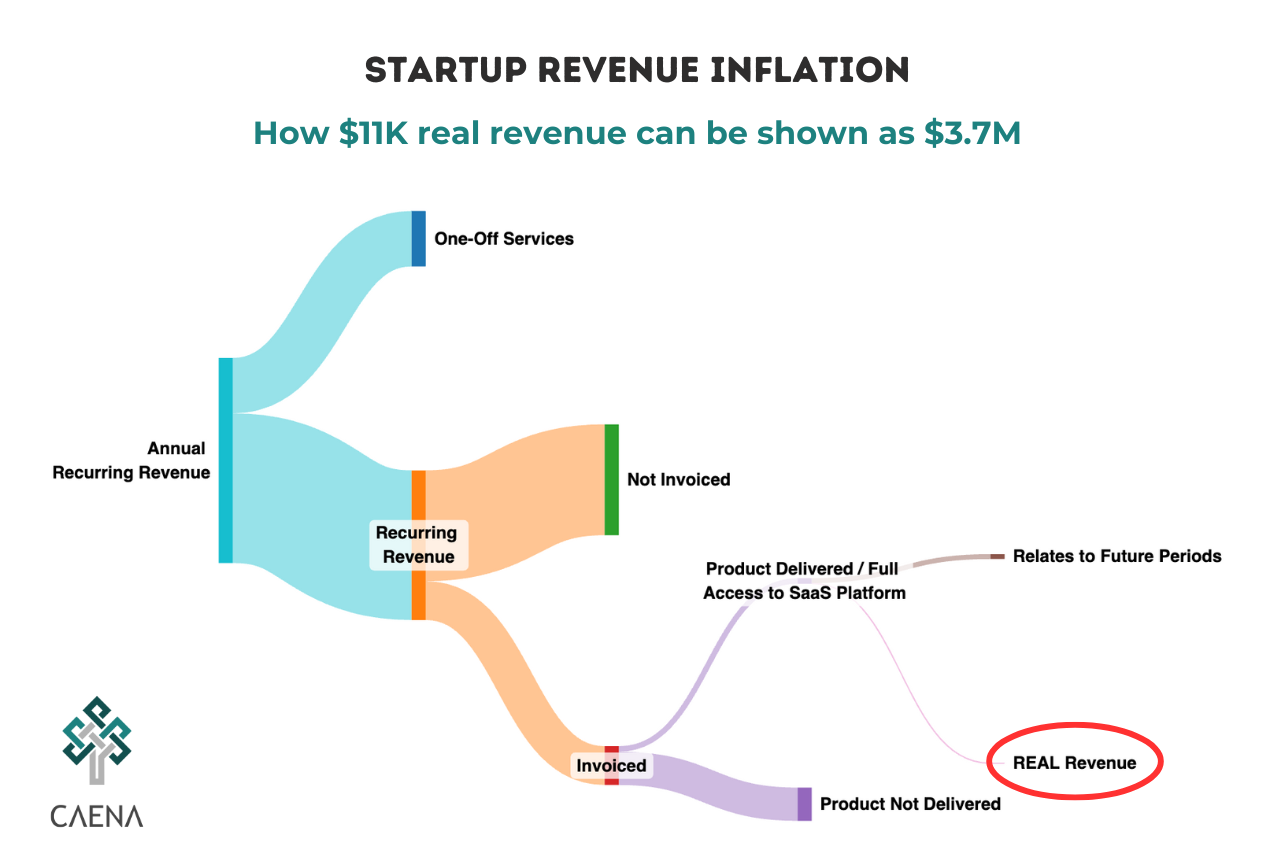

Over the years, she claimed her company had an Annual Recurring Revenue (ARR) of $3.7 million but the actual figure was only $11,000. Ms. Smith-Griffin used misrepresented revenue figures and a non-existent customer base to fraudulently raise close to $10 million. The story gets better, once the company’s valuation had climbed, she sold some of her stake in the company to fund a down payment for a new home and on her wedding.

Ms. Smith-Griffin now faces 40 years in prison.

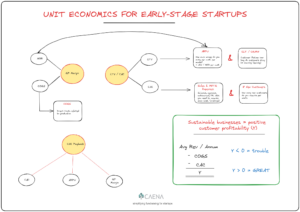

The diagram below depicts possibly how the AI startup (could have) arrived at a revenue figure that was more than 300x their actual numbers! Some of the possible tricks used by founders to fool investors could be presenting services revenue as recurring, recognizing next periods revenue in current period or even recognizing signed contracts as revenue.

The examples mentioned earlier emphasise the importance of conducting due diligence, and more importantly financial due diligence (FDD). Investors should bear a lot of the blame for not conducting basic due diligence to ensure that they are putting their money into legitimate, revenue generating businesses.

Understanding Financial Due Diligence

Financial due diligence is the process of systematically evaluating a company’s financial health and operational viability. Unlike surface-level assessments, FDD dives deep into a startup’s financials to uncover the true state of its business, and this process involves analysing revenue streams, cash flow, liabilities, and the overall sustainability of the business model.

Main Areas to Focus on During Due Diligence

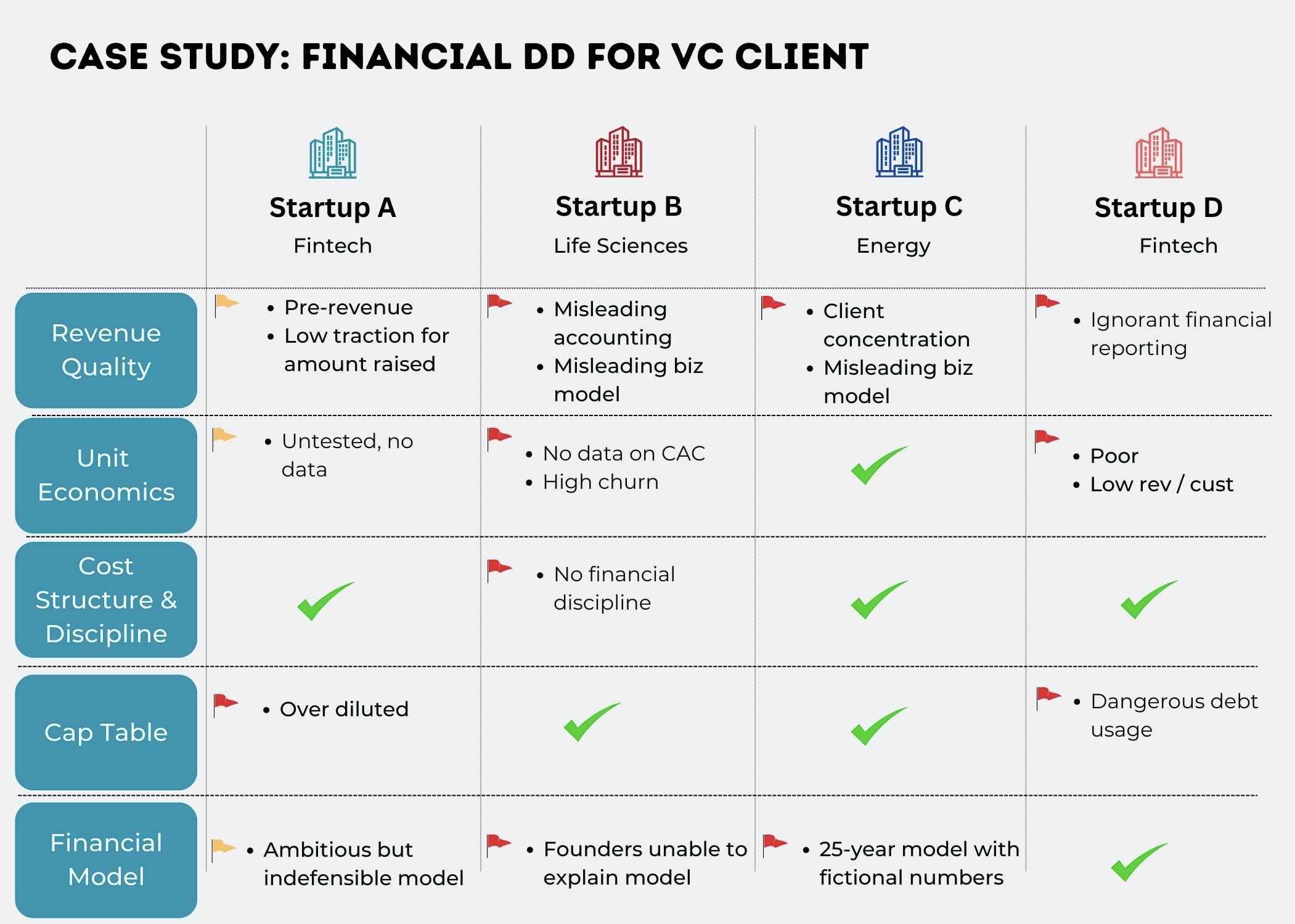

Below we have an extract based on a financial due diligence project we were tasked with for a US-based early-stage VC fund investing in breakthrough technologies. Our task was to conduct FDD on four potential investee companies and to highlight any potential red flags based on our findings.

Investors, here are 5 key areas to look out for when conducting due diligence on startups.

- Revenue Quality

Revenue quality indicates the predictability, reliability, and scalability of a startup’s earnings. Usually startups with diversified, recurring revenue streams are more resilient to market fluctuations. For investors, poor revenue quality may signal high dependency risks or unsustainable growth, which can undermine long-term value creation.

Key Areas to Evaluate

- Revenue Sources: Diversification across products, customers, or markets.

- Recurring vs. One-time Revenue: Recurring revenue offers long-term stability.

- Business Model: Revenue streams should align with the startup’s stated model.

- Unit Economics

Strong unit economics demonstrate that the startup has a viable business model capable of scaling profitably. Negative or weak unit economics suggest that the company might rely heavily on external funding to grow.

Key Areas to Evaluate:

- Customer Acquisition Cost (CAC): How much does the startup spend to acquire a customer?

- Customer Lifetime Value (CLV): What is the net revenue generated over the customer’s lifecycle?

- Cost Structure & Financial Discipline

Startups with disciplined financial management and a sustainable burn rate are better positioned to weather economic uncertainty. Poor financial discipline, such as overspending on non-core activities, could lead to a premature cash crunch, necessitating emergency funding on unfavorable terms or even bankruptcy.

Key Areas to Evaluate

- Fixed vs. Variable Costs: Analyse the startup’s cost structure. High fixed costs may limit flexibility during revenue downturns, while a lean cost structure allows adaptability.

- Burn Rate and Runway: Determine the monthly cash burn and how long the company can operate without additional funding.

- Expense Allocation: Evaluate whether spending is focused on growth and core operations (e.g., R&D, customer acquisition) or on non-essential areas.

- Cap Table

The cap table reveals the alignment of interests among founders, employees, and investors. A poorly structured cap table can lead to conflicts, demotivate key stakeholders, and diminish potential returns. Understanding the cap table ensures that investors can ensure that their rights and interests are protected.

Key Areas to Evaluate

- Equity Distribution: Are the founders retaining enough equity to remain motivated, or has excessive dilution occurred?

- Investor Rights: Review the rights granted to previous investors, such as liquidation preferences, anti-dilution provisions, and board control.

- Future Dilution Risks: Assess whether the company has room for future fundraising without significantly eroding investor returns.

- Financial Model

A robust financial model provides a roadmap for the startup’s growth and helps investors assess its long-term viability. Flawed models with unrealistic assumptions can lead to overvaluation and misaligned expectations, resulting in poor investment outcomes.

Key Areas to Evaluate

- Assumptions: Scrutinize the assumptions behind revenue growth, expense management, and market size. Are they realistic and backed by data?

- Cash Flow Projections: Assess whether the startup’s cash flow projections align with operational needs and fundraising plans.

- Scalability: Determine whether the model supports scalable growth without exponential cost increases.

For startup investors, evaluating these five areas during the FDD process is essential to identify risks, validate the company’s growth potential, and safeguard investment returns. Each area provides unique insights into the startup’s financial health and operational capabilities, enabling investors to make more informed, strategic decisions.

The Cost of Skipping Due Diligence

Due diligence needs to be thorough; it can be time consuming, but it will save investors a lot of trouble and money. Here is one final, very recent, example which underscores its necessity.

In January 2025 Indonesian unicorn eFishery, an agri-tech startup specializing in smart feeders for fish and shrimp farmers, faced allegations of inflating its financials over several years. Reports estimate that the company overstated revenue by almost $600 million in the first nine months of 2024, making more than 75% of its reported figures fake!

Backed by high-profile investors like Japan’s SoftBank Group and Singapore’s Temasek, eFishery was valued at $ 1.4 billion during its most recent funding round, led by G42. The company had claimed a profit of $16 million for the first nine months of 2024. However, investigations reveal a loss of $35.4 million.

This is yet another prime example of poor financial oversight and the lack of rigorous financial due diligence by investors. Adding to this, the company’s financial results had been audited by top-tier firms such as PricewaterhouseCoopers and Grant Thornton, which are now accused of failing to identify these discrepancies. When startups manage to inflate financials unchecked, it not only signals lapses in internal controls but aloes raise questions about the rigor of even the most reputed auditors.

For investors, the lesson is clear: robust financial due diligence is indispensable, as neglecting it can result in catastrophic losses.

While the above concerns are valid, they pale in comparison to the potential losses from a failed investment. A recent analysis revealed that startup failures due to financial mismanagement cost investors over $20 billion annually. For individual investors, a single failed investment can mean losing millions, not just in capital but also in potential returns. When a startup collapses due to financial mismanagement or hidden risks, the fallout can be devastating. Beyond the immediate financial loss, there’s the opportunity cost of what that capital could have achieved elsewhere, not to mention the damage to an investor’s reputation.

Investing in FDD is, in essence, an investment in the future.

It’s not a guarantee of success, but it significantly increases the odds of making sound decisions. In the long run, the benefits of avoiding failed investments far outweigh the upfront costs of due diligence.

There are many examples of horror stories of startups that have run away with investors’ money by misrepresenting the business or have failed to truly understand the market they are operating in. All this serves as a reminder of the importance of financial due diligence. In a world where startups are often celebrated for their vision and potential, FDD brings much-needed rigor and accountability to the investment process. By prioritizing due diligence, investors can protect their interests, build stronger portfolios, and contribute to a more sustainable venture ecosystem.

Financial due diligence isn’t merely a box to tick, it’s the foundation of informed and responsible investing. At Caena, we understand the critical role it plays in uncovering the true potential of an investment opportunity. If you’re an investor or fund seeking expert support in navigating the complexities of due diligence, we’re here to help. Let’s connect and discuss how we can work together to ensure your investments are as sound and successful as they can be.