How to Navigate a Successful Mergers & Acquisitions Process for Founders

To help VC-backed startups and their investors navigate this process, we co-hosted an online workshop, M&A Readiness for VC-Backed Startups: How to Maximise Exit Value, on January 30, 2025. (Checkout it out here) The session brought together three experts in M&A, venture capital, corporate law, and startups, covering the key elements of successful M&A, offering startups insights into why they should remain open to acquisitions, how to prepare for them, and strategies for success. (LinkedIn post)

The full session is available on Youtube below. Here are the key takeaways for those who missed the session:

The Chances of Getting Acquired Are Very Slim

For startups that have raised venture capital, providing exit liquidity to investors is not a choice, but a must. There are four main ways investors receive their initial investment and returns – dividends, secondary sale (to another investor), acquisition or IPO. For the purpose of this webinar, we focused on M&A which is the most common option for venture-backed, fast-growth startups.

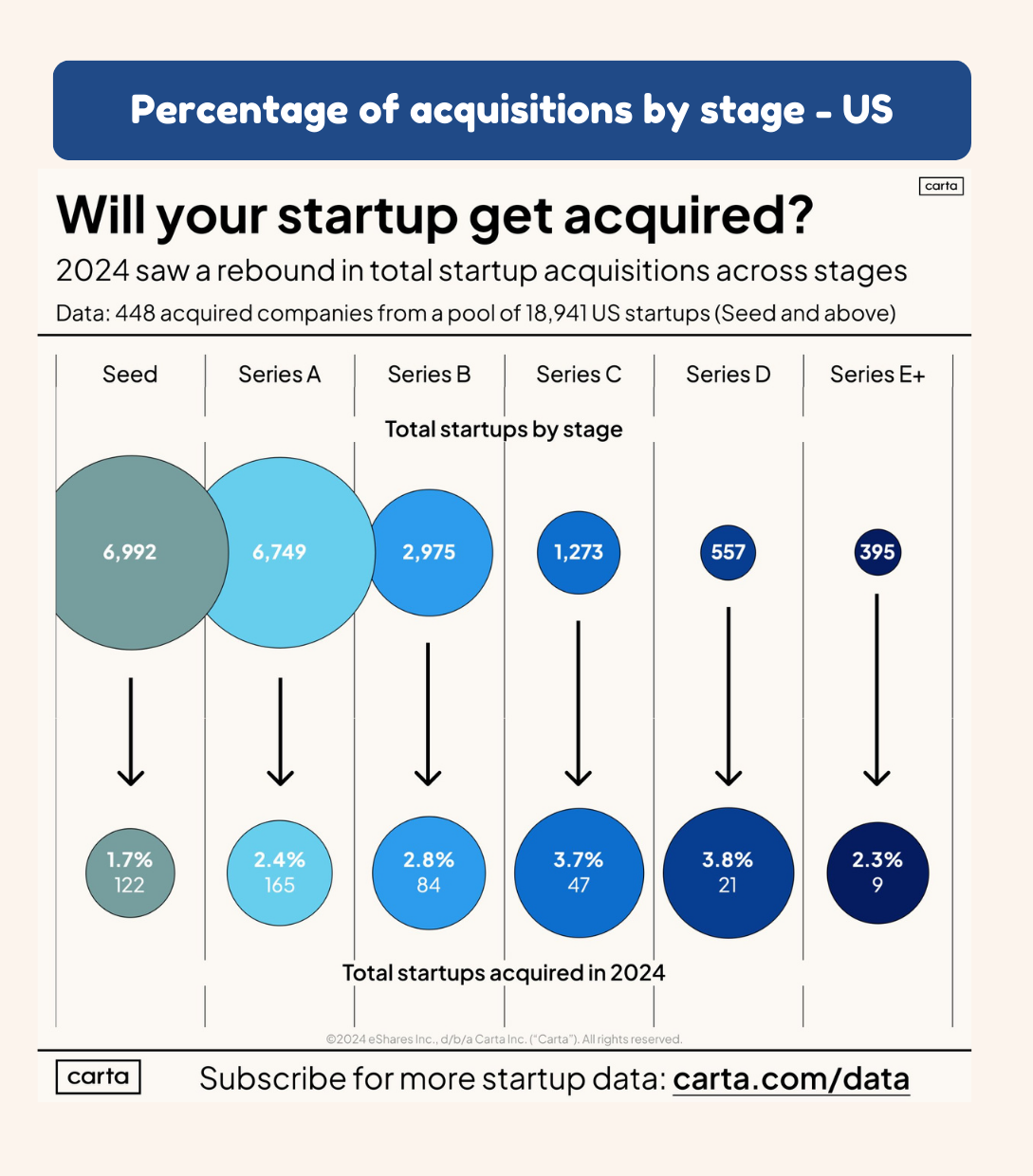

Yet, the chances of achieving a successful M&A are slim. According to insights from Carta, only about 2.3% of startups successfully get acquire across all stages. This means if you’ve raised venture capital and know you would need to exit someday, you need to work really hard to improve your chances of a successful exit.

Acquisition rate across Seed to Series E+ for startups in the US

Advice for Founders: be visible

“Build visibility and make your company known. Just be out there. There is no harm in receiving offers and you can always say no.” – Sophie Long

Startups Are Bought, Not Sold

Founders should concentrate on creating a business that naturally attracts acquisition interest. This means investing in strong product development, robust financial performance, and a compelling market presence that resonates with potential acquirers. As Kayode emphasised during the session, an acquisition offer is rarely the first time a buyer hears about you; instead, it’s the result of long-term relationship-building and a consistently attractive value proposition.

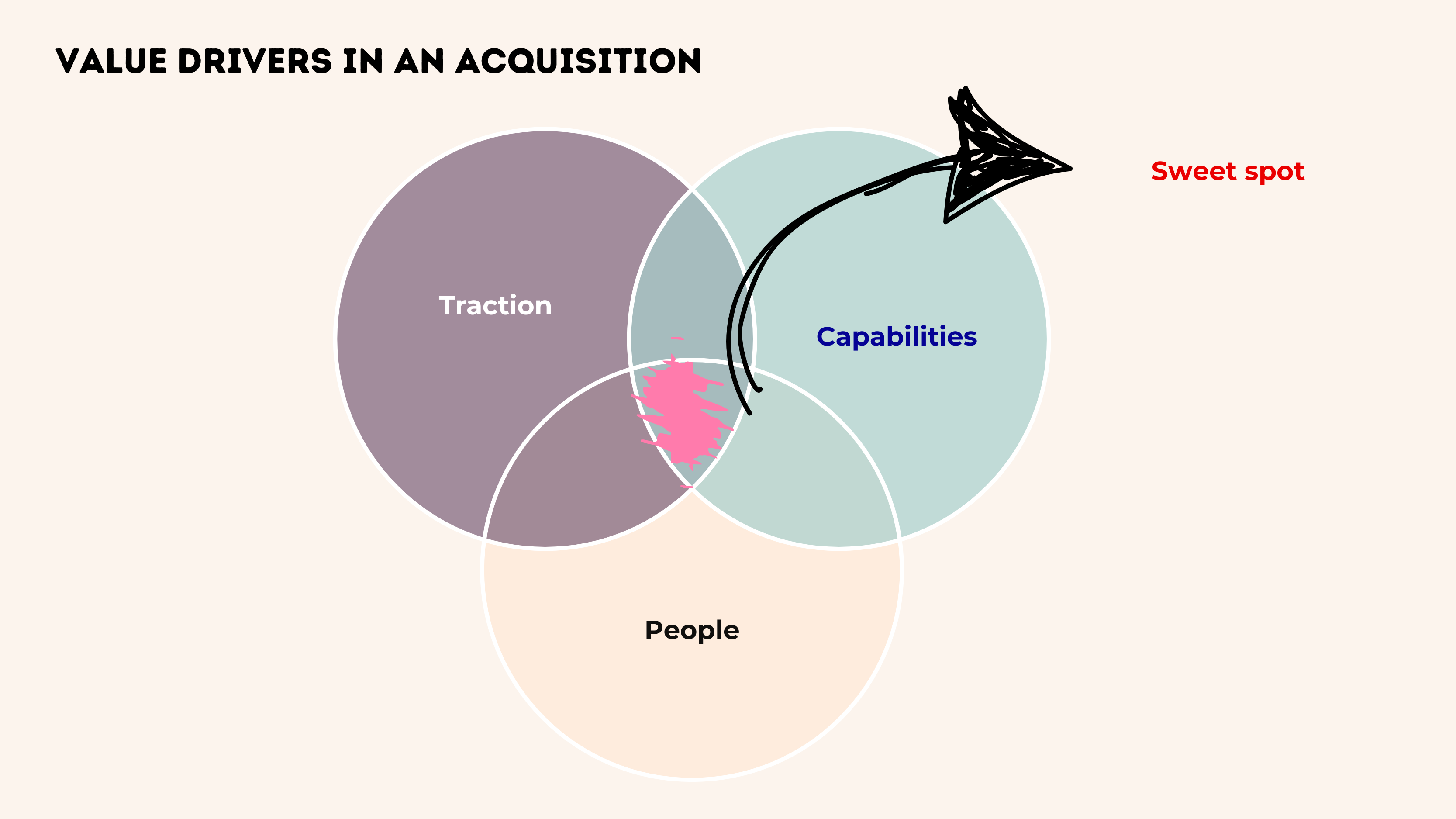

“Building a company that’s highly attractive to acquirers is the best way to secure a strong exit. If you have all three capabilities that are appealing to a specific buyer, thnn an acquisition is almost certain” – Kayode Odeleye

“As a founder or investors backing founders, the key question you need to ask yourself is what’s in it for the acquirer?” – Kayode Odeleye

Acquirers typically look for one or more of the following:

- Traction: This can include financial performance, customer base, profitability, or the markets the business operates in.

- Capabilities: Acquirers may be interested in unique technology, proprietary products, or innovations not available within their own company.

- People: In service-oriented businesses, talent is often the most valuable asset. Companies with strong in-house talent and the ability replace/ hire similar talent as the company scales is what acquirers find attractive

- “Focus on building a people machine.” – Sophie Long

Receiving a Term Sheet Does not Mean it’s a Real Deal

Fishing expeditions are a common pitfall in the M&A process, where acquirers engage in exploratory due diligence without a real commitment to the deal. As Kevin Withane pointed out during the session, “I’ve done it as a fishing exercise as well, so you have to be careful.” This approach involves probing your startup’s operations, technology, and market potential without clear intent—essentially testing the waters. Such preliminary inquiries can consume valuable time and resources, potentially distracting founders from more serious opportunities.

Founders can protect themselves by ensuring you don’t offer up very confidential information until you’re sure it’s a sincere offer. Also getting to know partners before getting into the acquisition conversation is very helpful.

“Acquirers might just want to find out more about a specific technology used or gain knowledge on some specific information on the company using an LOI and will pull out of the deal once they have the answers they wanted.” – Kevin Withane

Relationships Matter

Establishing relationships with potential acquirers is crucial, as these connections improve the chances of a successful exit and minimize deal-making challenges.

For example, Kayode Odeleye mentioned an example of how a guy who sold his company to Adobe. He says that the acquisition was completed in 2 weeks but they had a relationship with them for over 5 years!

Strong relationships can expedite due diligence and reduce uncertainties, and can help distinguish real opportunities from exploratory inquiries. An acquirer familiar with your business and team will require less vetting, expediting the due diligence process and increasing the likelihood of deal completion once an LOI is signed.

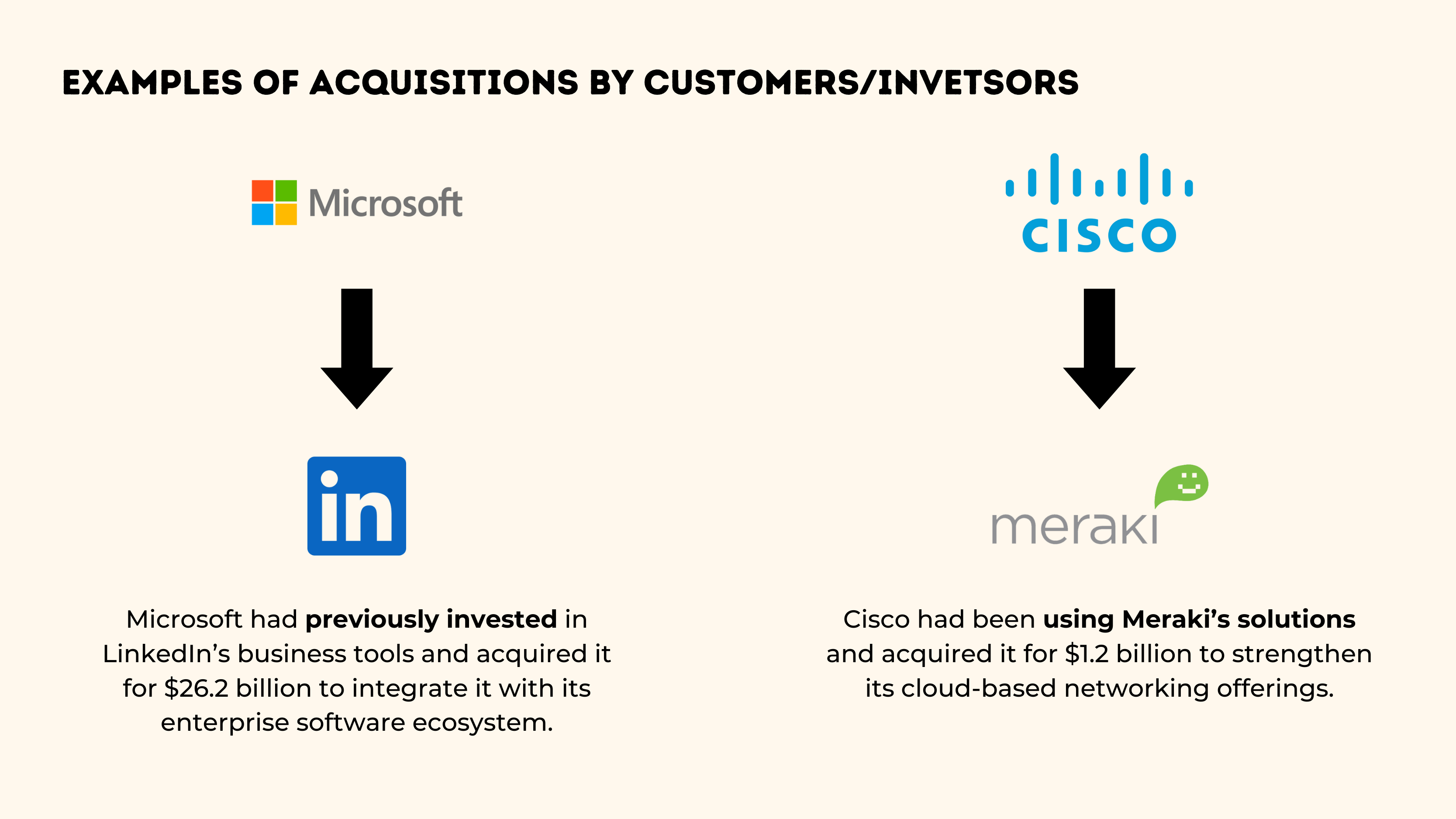

The above cases are good examples of how startups positioned their products in a way that pushed their customers to acquire them.

Advice for Founders: Focus on building relationships

Acquisitions require both early relationship-building and being proactive. As Sophie notes, “You can always say no to an M&A offer, but if you’ve had a few along the way, you’re getting fantastic insight into how to run your business and really understand what else is out there in the market.” Meanwhile, Kevin emphasises the importance of involving lawyers from the LOI stage to streamline due diligence and avoid “fishing expeditions.” Keep critical documents up to date and stay transparent to preserve your company’s value.

“Bring on potential acquirers into the business early, either as customers, clients or ideally as investors.” – Kayode Odeleye

Be Organised & Manage the M&A Process Tightly

The last thing you want during due diligence is for investors to uncover hidden issues. Transparency builds trust, and investors appreciate knowing the full picture so they can address any challenges early.

Being upfront about weaknesses can demonstrate opportunities for improvement and upside potential. Concealing problems can be a major red flag and damages credibility.

Advice for Founders:

- Don’t leave any surprises for acquirers. Be proactive and transparent about challenges.

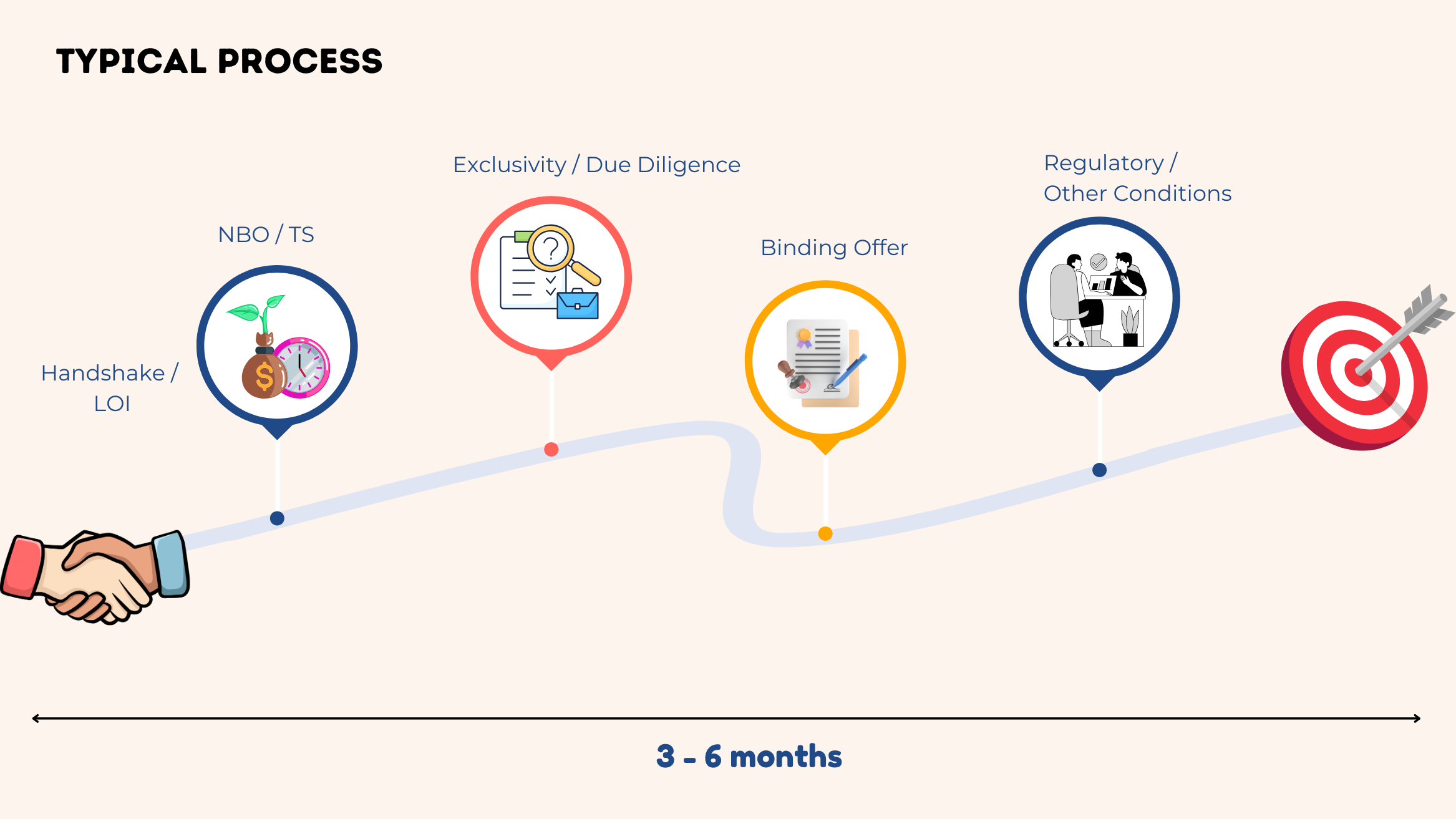

Acquisitions Take Time

M&A is a lengthy process, often taking up to 18 months. Thinking about an exit only when challenges arise is too late. M&A takes time, and early planning is key to maximising exit value.

“Work towards identifying who the business’ potential acquirers are and start building those relationships early on.” – Sophie Long

There is value in nurturing long-term relationships— through regular engagement, meetings, partnership deals and even casual coffees— can turn into strong acquisition opportunities.

“Have early discussions about potential exit options and work towards being acquisition-ready. Delaying too long can diminish value, potentially leaving you as a “zombie” company.” – Kevin Withane

From the moment a company decides to pursue an acquisition, substantial preparation is required before engaging with potential buyers. Startups must align stakeholders interests, set KPIs, restructure teams, and conduct gap analyses.

Even after the deal process begins, it’s important to keep your options open. Until a deal is finalised, founders should avoid being overly reliant on one acquirer, getting carried away by high valuations, or assuming a deal is guaranteed.

Advice for Founders:

- If you are desperately in need of an acquisition, it’s already too late. Plan well in advance.

- “Get your lawyers involved early during the deal making stage, from when the LOI is being drafted for them to better advice on deal terms and specific”. – Kevin Withane

Final Thoughts

Acquisitions are like dating. Founders must be patient, avoid desperation, and always have a backup plan. The right acquirer understands and supports your business, leading to a strong, long-term partnership. One recurring question we often get is “when should I start preparing for an exit?” The answer will differ for each circumstance but a useful rule of thumb is this -once you raise a Seed round and are working towards a Series A, it’s useful to start to have an M&A as an option.

Get in touch for a free consultation and gap analysis.