Strong founder financial literacy is as important to startup success as it is to investors achieving their returns objectives

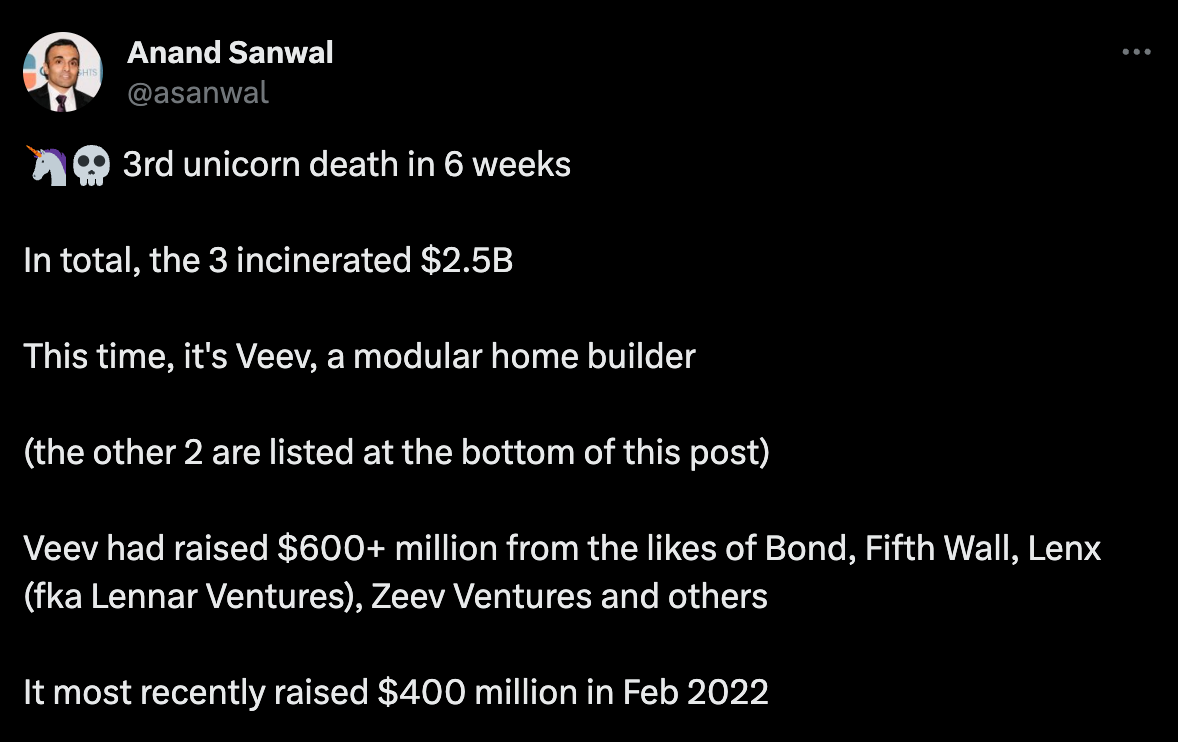

One fallout of the current funding environment is that so many startups that raised millions of dollars in funding are shutting down because of an “inability to raise further funding.” On further analysis, it becomes obvious that poor founder financial literacy is the real root cause. Issues with the funding environment is just a convenient excuse for these failures. Unfortunately, there is more pain coming as more companies run out of runway and crash, wiping out their dreams and investors.

Founders build startups for several reasons, meaning the definition of success is fluid – it could be to change the world, for personal freedom or financial return. On the other hand, the biggest reason investors back startups is to make a great return. For venture capitalists (VCs), this return has to be 50–100x their initial investment over a 7–10 year period for the investment to have been a worthwhile one.

When the going was good (a.k.a during the decade of easy money or ZIRP), building a successful startup that generated this return seemed easy. Found a startup, generate enough hyper, keep selling to the “greater fool” all the way to IPO and everyone goes home happy. Except for the retail investors that are left holding the bag after purchasing the shares of loss-making startups at IPO.

A retail investor who bought $10,000 shares of Bird Global on November 5, 2022 at IPO would have his portfolio reduced 99.8% down to $2. Not $2,000; not $200 but $2! With a return to more realistic monetary policy, building a startup is closer to building a traditional business in terms of what is required – build something people want, that they will pay for and that you can produce for (much) less than the price you’re paid. For startups, this means doing their homework to ensure they’re pursuing ideas that are worthwhile. For investors, this means asking the right questions. There are various financial skills and tasks required at various stages which we will explore in detail.

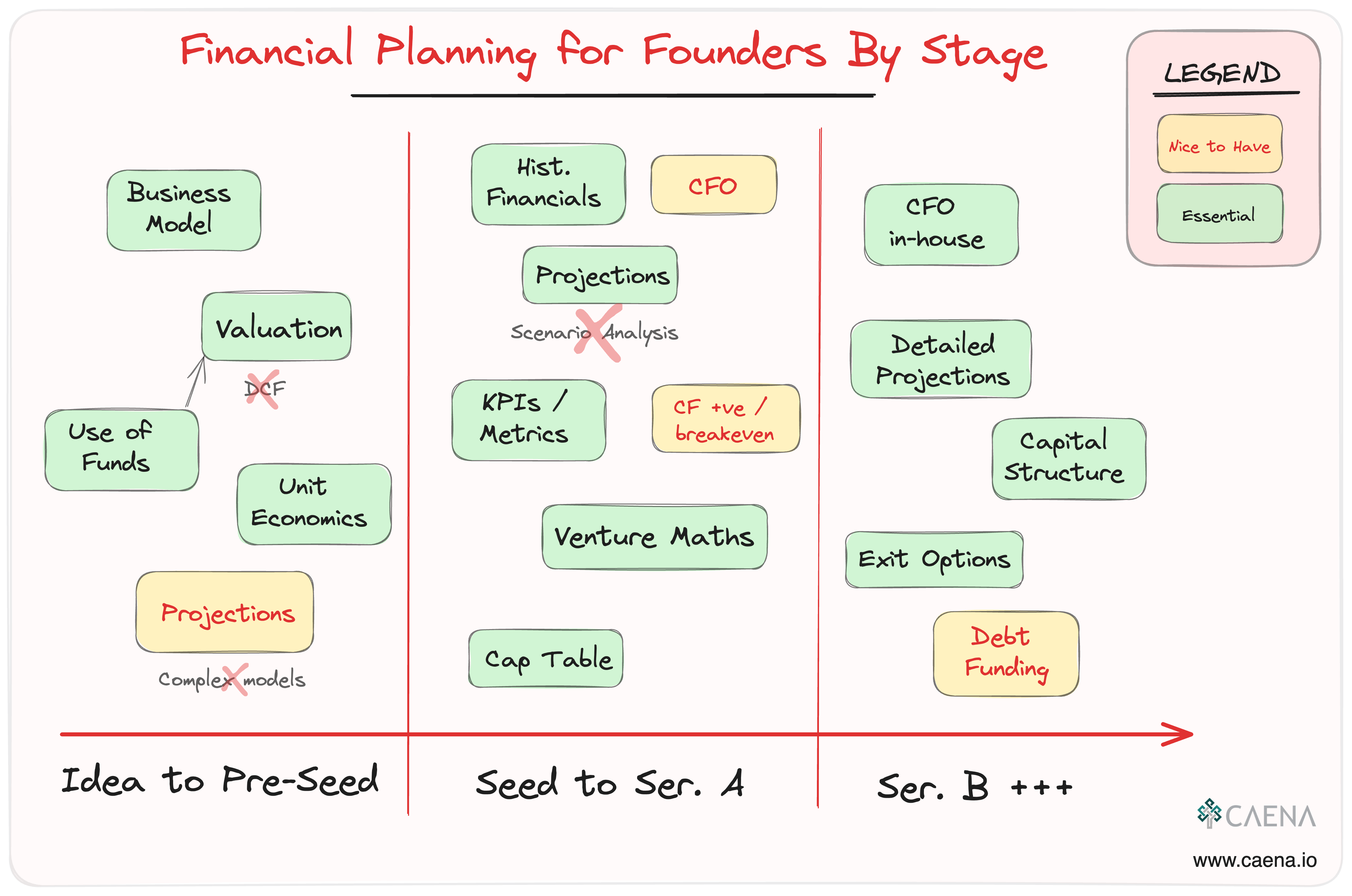

Idea to Pre-Seed Stage: Laying the Foundation on Good Unit Economics

One of the first questions you need to answer as a founder at the earliest stages of your startup is this: “Under what conditions is this idea viable as a business?” This step is about understanding the basic cost structure, potential pricing and volumes required for the business to be viable. “But I cannot carry out this exercise as it’s too early!” Agreed. This step could be delayed slightly while the founding team better understands the market. Yet, there are several startups who have spent hours perfecting their pitch decks, and they are raising from investors without being able to answer basic questions around their business model.

Here are the questions you should be able to answer with confidence in early-stages or at least as soon as you’re ready to speak to investors.

- Business Model: Your business model is just a slightly fancy way of answering the question “How will you make money?” Will it be subscriptions? Adverts? Product Sales or Commissions? Will it be a combination of these? By the time a founder is raising funds, they have to be able to answer this question confidently.

- Valuation Basics: Valuation is one of those concepts that trips up most early-stage founders. Many founders I’ve come across just struggle; it’s either they pay thousands of dollars to consultants who provide some fancy report valuing the brand new starup at $30 million or they just pick an arbitrary figure. Valuation at the earliest stages should be very simple, see more details here for calculations and examples.

- Use of Funds: This is so straightforward it shouldn’t need emphasising. Yet, I’ve spoken to several startups who are raising hundreds of thousands of dollars and cannot clearly say what the funds are for. Your use of funds should clearly show:

- Split of funds between major spending buckets – ideally at the early stages, >90% of your funds should go to either building or selling.

- Milestones you will achieve with the funds – within 12 to 18 months, what traction will you achieve? Will these funds take you to $1 million ARR? Triple number of clients? Or both?

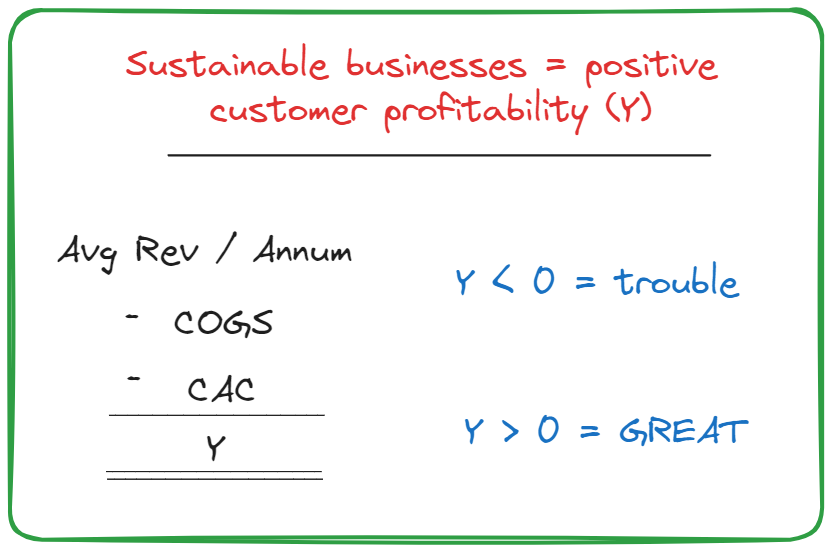

- Unit Economics: Tech founders are just starting to wrap their heads around the importance of this concept. Enforced by the same investors who—just 2 years ago—were encouraging them to grow, grow, and grow.

Founders now need to demonstrate that their business is financially sustainable, i.e. customers are willing to pay more than it costs to produce and sell. See our guide on unit economics for startups for more details.

However, no matter what happens please DO NOT

- Build complex financial models: No investor wants to review a 12-page financial model of a startup that is pre-product, pre-revenue. The numbers are completely worthless and unreliable at this stage. Investors want to gauge your understanding of the key drivers of your business and not an accurate prediction of how you will make money.

- Value your startup using DCF: Discounted cashflow (DCF) valuation is a popular valuation methodology in corporate finance that is NOT suitable for early-stage startups. If you’re pre-Series A, please do not listen to any consultant offering to build detailed valuation models for you. No investor is going to rely on those numbers.

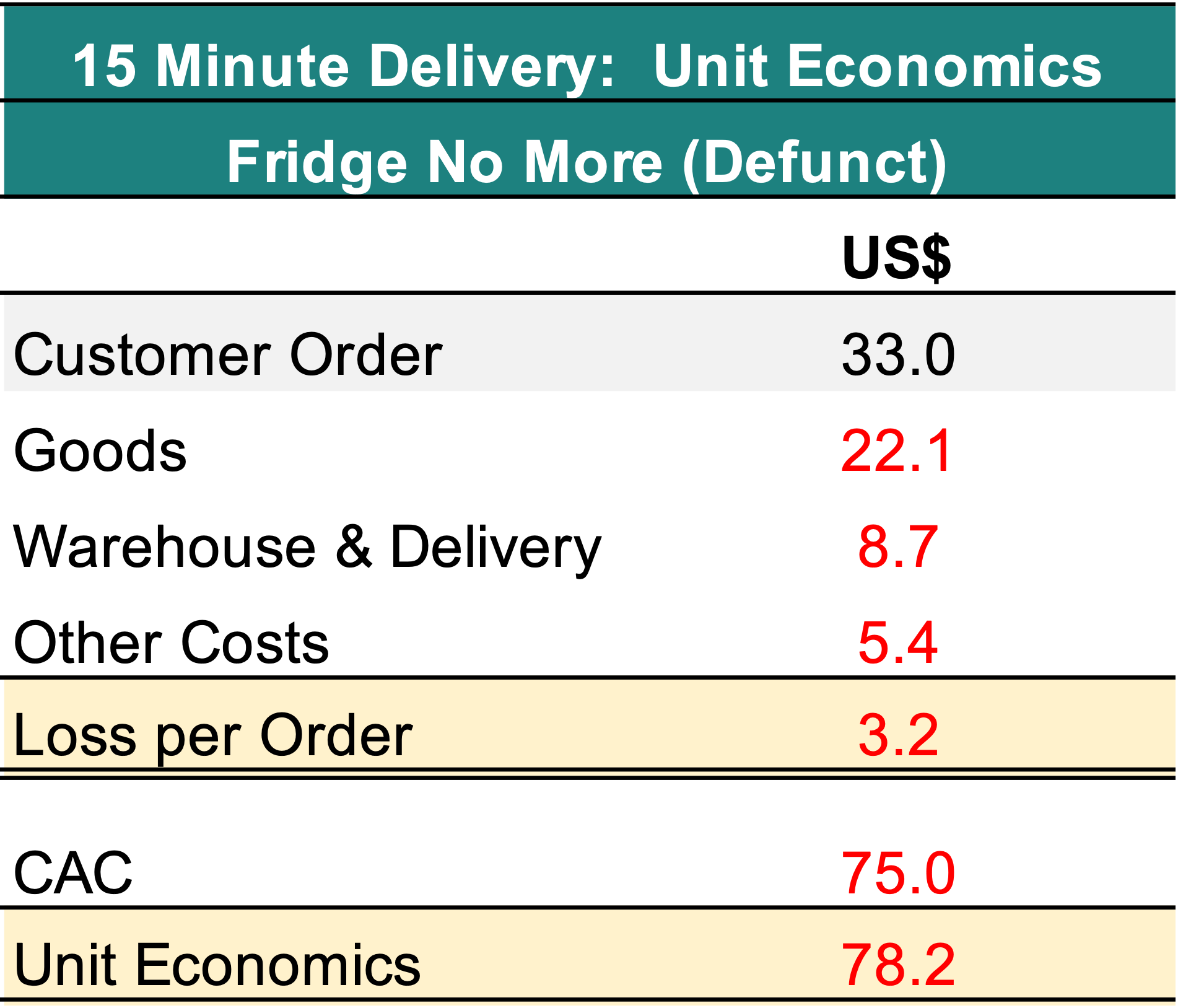

Investors, faced with the prospects of rapidly liquidating portfolios, are now evaluating investment opportunities from a different lens. Founders now need to demonstrate basic financial literacy at the earliest stages to give investors some confidence that their money isn’t going down the drain immediately. Obviously, when the going was good this wasn’t the approach. Otherwise, 15-minute grocery delivery startups—Fridge No More, Buyk, Jokr and Gorillas to name but a few—would not have been able to raise and burn through over $5 billion before flaming out.

Fuelled by the pandemic, these startups grew uber-fast but the numbers never made sense. For instance, Fridge No More was losing $3 per order according to the Wall Street Journal, that is before spending $72 in marketing and before considering other admin costs. Perhaps the assumption was that it was all going to make sense at some massive scale but I doubt any investor actually considered the numbers before jumping on the FOMO train.

Now investors are asking for all sorts of numbers at early stages.

Seed to Series A: Scaling Sensibly

As startups successfully scale the early and doubt-filled days towards product-market fit, founders need to be ready to answer more in-depth questions about their financials – past and future projections. It is also more likely that investors will conduct a thorough financial due-diligence process to validate claims and assumptions.

Assuming the basic areas from the earlier foundation stage are covered, here are a few areas to build on:

- Historical Financials:

With some months or even years of revenue projection on the books, there is something to build on. This is both a blessing and a curse. If past financial performance has been less than stellar, investors will scrutinise that and want to know why. This shouldn’t be an issue as long as a founder can explain the reason for the low numbers and initiatives they will pursue to change the trajectory. - Developing Robust Financial Projections:

Financial projections start to take on a higher significance at this stage. Investors want founders to demonstrate ambition and a clear understanding of the assumptions required to achieve the targets. If you’re raising from institutional investors, expect VC analysts/associates to spend hours tearing apart your financial model. Your financial model should exhibit the typical hockey stick shape, going from zero to ~$50 million in five years but with defensible assumptions. - KPIs and Metrics:

The key question founders need to answer here is this: “Is your startup on the right path to meeting next set of funding and business milestones?” At the Seed to Series A stage, these numbers must tell a story of growth and potential. Important metrics include customer acquisition costs, lifetime value, monthly recurring revenue, and customer churn rates. These figures help investors understand the startup’s performance and predict future growth, thereby playing a significant role in funding decisions and valuation.

Be Confident and Consistent

Financial planning isn’t easy but it is not as overwhelming as it’s made out to be. Founders at all stages can get a hang of their numbers especially when you use a software like Caena to simplify your financial modelling. Founders can build detailed financial models in less than 30 minutes, even with no prior financial knowledge.

With Caena, you don’t have to worry about complex calculations in spreadsheets or those nasty error messages. It saves you time and money so you can focus on what really matters.