It is incredibly difficult for angels to make meaningful returns when playing the VC game

A couple of months ago, a mentor made an intro to a wealthy friend of his who happens to be one of the most active angel investors in the region so I could pitch my startup to him. I was excited at this unique opportunity, but my hopes were dashed just a few minutes into my call with him. “Your idea is great, but I only invest in startups where I can make 100x return and who are on a sure path to becoming unicorns.”

This was my first introduction to a class of angel investors — what I’ll call the professional angel investors. I’d previously raised from angels who invested in me and the idea. Ultimately they believed I would succeed and wanted to be part of any upside but they weren’t outrightly basing their investment decision on the potential of a large outcome. Pro angels, on the other hand, are playing a different game similar to VCs – get in early into startups run by high profile founders with the hope of achieving outlandish, venture scale returns on at least 1 to 2 investments while the others can be meh.

Every investment is high risk, and moreso startup investments. Chasing unicorn and fund returning investments is a different level of risk entirely which was not so obvious in the past 3 years. A recent article projects that at least 50% of Unicorns are expected to fail given the current funding environment. On a recent angel investor syndicate call where I listened in , the bulk of the conversation was around their concerns about their portfolio companies’ ability to raise capital to stay alive amidst the downturn.

In the last 3 years, we saw the Unicorn Club pass 1K+ "members." Many of them have:

✅ $1B+ valuations

✅ Years of runway (maybe)

✅ <$100M revenueBut a lot of VCs are predicting that 50%+ of those companies could fail. Here are the most likely reasons why… pic.twitter.com/ROrdruKcTr

— Kyle Harrison (@kwharrison13) January 20, 2023

Angels are the most vulnerable in cap tables and most vulnerable to losing it all when a startup fails or even when it succeeds (more on that later). They typically have the least control in a startup — legally and practically and as such it’s common to get squeezed out by founders and VCs when things go awry.

A tale of two angel investments

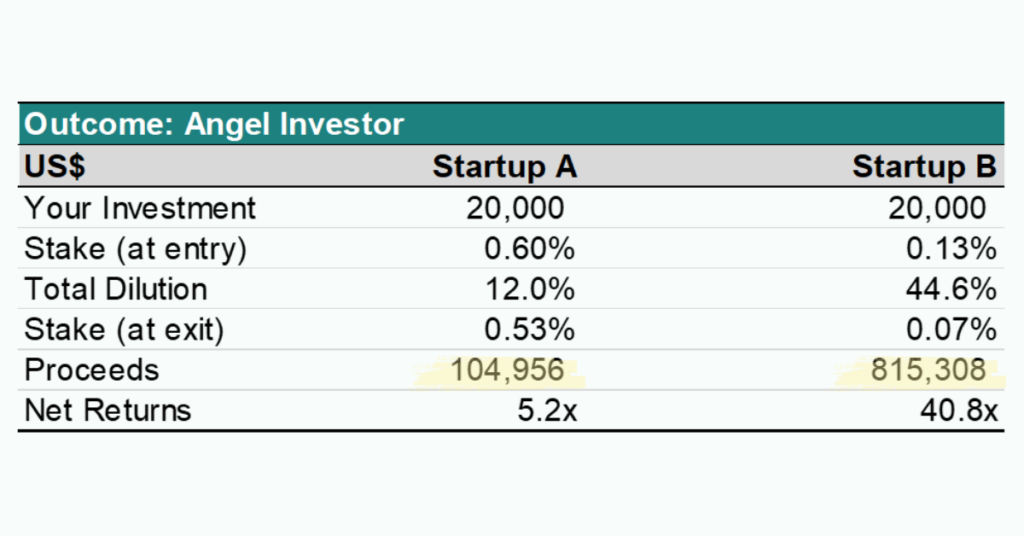

It’s December 2022 and you invest £20,000 each in two startups you consider great opportunities. Both are raising their seed rounds and both of them are at roughly similar stages in their business with a working MVP. The first startup led by Maya ends up raising $500,000 for her SaaS and marketplace startup. Michael, the founder of the second software startup is raising $2,500,000 and your 20k goes in as part of an angel syndicate given the minimum cheque size of $100,000.

- Your investment in Startup A (Maya) is on the premise of a steady growth of a niche business. The founders never promised lofty returns and in fact made it clear they wouldn’t be pursuing venture capital as a source of capital to grow.

- Startup B (Michael) on the other hand came with all the bells and whistles projecting astronomical growth. It was clear they would need many rounds of funding to fuel geographic and product expansion. They also projected massive spending on marketing to ensure they became market leaders in their category

Given the similar starting point but different growth strategies off the bat, what would be required for each startup to achieve modest success and provide returns to its investors?

How will they grow and how will this impact valuation?

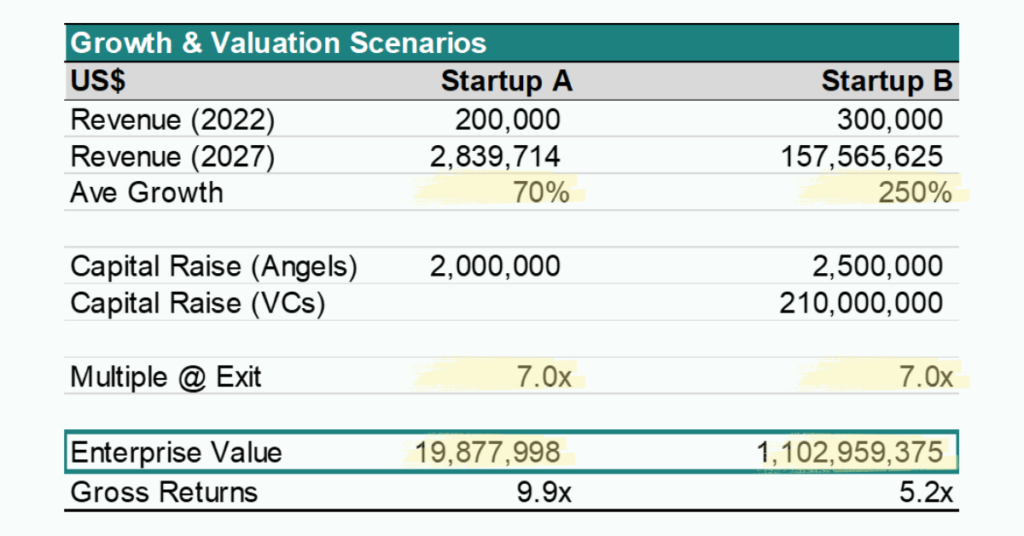

Thankfully it’s been talked about more often now and founders are aware of the trade offs involved in the venture capital game. The growth and valuation outcomes for each startup to be considered successful are widely different. Assuming an acquisition at the end of 2027 (5 years after your initial seed investment):

- Maya and team could grow on average 70% a year to an Annual Recurring Revenue (ARR) of $2.8 million and exit at around $20 million. This assumes the business grows quickly in first two years to ~1 million ARR and then slows down to around 30% annual revenue growth. We also assume they raise a further $1.5 million over the 5-year period but all from angels and not venture capital.

- For Michael’s startup to be considered moderately successful, they would need to grow at an astronomical 250% year-on-year. This would typically mean 5x growth in first 2 years and then slowing down to 3x and then 2x by outer years. Of course, a lot of fuel would be needed to power this growth and we assume Startup B raises over $200 million largely in venture capital over the period.

Because Startup A is capital efficient, they return a gross multiple of ~10x over the total amount they’d raised while Startup B’s total returns are only about half of that.

As a seed-stage investor, your returns are far higher with the venture capital fuelled startup than the slower growth investment. Clearly justifies being a “unicorn-chasing” angel doesn’t it? Not so fast

What about the risks?

Venture capital firms understand the risks of their power-law driven model and are set up to manage those risks accordingly. The danger for angels playing the same game is that they are not as equipped to manage those risks. It is very hard to make money even for the best, most prominent angel investors.

I’ve been doing angel investing for about 10 years.

I’ve probably made close to 100 investments.

But, after a few years of doing it, I came to realize it was almost impossible for me to make money at it.

🧵

— Marc Randolph (@mbrandolph) December 13, 2022

For a startup to exit in a mega acquisition or IPO, it would have raised hundreds of millions in funding and be backed by sophisticated investors. The danger for the early backers especially angels is that they typically don’t have board seats or any decision making power. As such the startup can succeed and still leave the angels out of pocket like the example below of an angel whose portfolio company IPOed but eventually ended up with nothing.

In our two scenarios, the first startup has many options for exits when they are profitable and a $20 million outcome is great for everyone. For the second startup who MUST exit >$1 million for the investment to make sense for all stakeholders, the options are far more limited. In summary, it’s the risk of achieving a large ARR outcome PLUS the risk of a willing buyer or path to IPO at the resulting valuation. This risk is one angel investors need to be mindful of when investing.

Update: board decided to recap, 4x liq pref and made a decision to exclude anyone who had not invested $1M or more. Insiders did the deal but recused themselves on the board vote. They claim it was a timing thing, needed to get cash in quickly. Founder voted for it. Thoughts? https://t.co/T7VM6bfMhH

— Jenny Fielding (@jefielding) November 30, 2022

So what should angels do to increase odds of success?

Investing outside the consensus will be the best returning investing thesis for angels over the next few years

My prediction for how angel investing will pan out over the next few years is as biased as any prediction. It’s simply a projection of the world I want to see and which I’m working towards with Caena.

To increase the chances of making decent returns, angel investors will have to create their own thesis and stick to it. The previously popular thesis of investing in only YC grads or “hot deals” brought by friends and other investors is unravelling and is only likely to get worse.

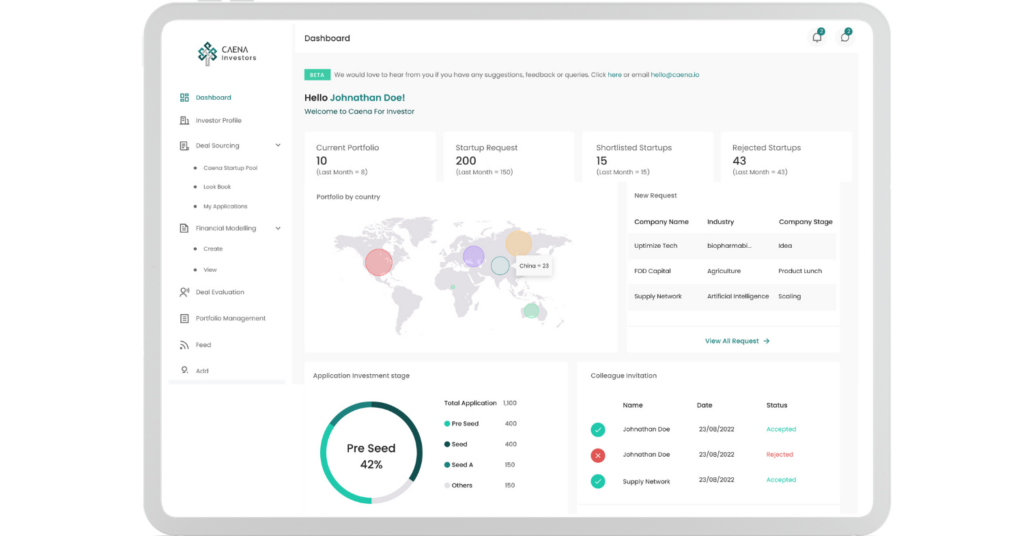

What we have built at Caena is a suite of easy-to-use tools specifically for angels and angel syndicates who want to chart their own path

- Deal Sourcing / Filtering: greatly simplifies your deal flow, saving you from sifting through 100s of startups to pick those that match your thesis. Our application link also provides a more customised and user-friendly option to airtables and typeforms for taking applications from startups

- Vetting / Evaluation: review financial models & other fundraising docs

- Portfolio Management (coming soon): standardise submissions and simpler approach to ongoing monitoring

Get started with an investor account by signing up here or get in touch