How to build a simple, investor-ready financial model for pre-seed and seed startups

Do I need a financial model when running an early-stage startup?

What if it is not a tech company but still a high-growth startup?

Why do investors ask for projections when it’s all guess work?

It’s all going to be wrong, so what’s the point?

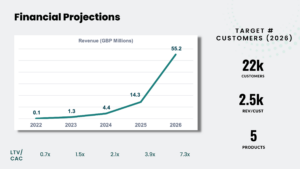

How do I present a financial model in a pitch deck?

These are some of the questions we’ve heard not only from early-stage founders, but also later stage founders raising capital for the first time. If that’s you, we’ve got you covered: read on to learn how to build out your first model, whether for an investment round or your own decision making process.

Do I need a financial model?

Yes, absolutely.

Assuming your intention is to build a long-term sustainable business, a financial model is a must-have for two reasons: to help you make better decisions (internal tool) and to help you convince investors and other stakeholders to commit to your startup (external storytelling tool).

Most founders we’ve worked with only start preparing financial models when fundraising. However, having a financial model on day one, BEFORE starting out at all is a useful discipline to ensure you build a sustainable business.

So it is important to distinguish between financial models for internal use and that for external use. Which brings us to…

How do I use my fundraising model for internal stakeholders?

Don’t! Here’s where we borrow from marketing and speak about the importance of knowing your audience and customising your financial model for each sub-segment. Your goals in preparing a model for internal external audiences will be different.

For internal audiences, like employees, the narrative of your financial model should speak to your plans for the business (short and long-term) and you’ll want to highlight how their contributions will help get there. Internal-facing models can be more conservative.

Investors, however, are mainly concerned that your company can generate a substantial return for them, so you should present your financial model in a way that shows you have an ambitious plan for a scalable business. At the same time, your assumptions need to make sense so it’s a balance between painting an optimistic, yet believable picture.

When do I need a financial model?

From the very beginning. The moment you go beyond toying with several ideas, make up your mind to go all-in on one idea, it is time to build a model.

Why do I need a model so early?

The assumption is that your idea is going to consume loads of money, time, sweat and blood. Why would you commit to such a process without at least a basic business plan? This plan definitely needs to include a financial forecast or you are flying blind into war.

What should my early-stage model entail?

You need a full three-statement model with all your assumptions spelt out in detail. Actually no, anyone telling you that is leading you down a path of destruction. At the earliest stages of your business you need a very basic model. Think a few lines of revenues, costs and one or two metrics.

There are three different elements of a financial model :

- Financial statements: Profit & Loss, Balance sheet and Cashflow statements

- Metrics: Profitability, cash generation and growth indicators

- Charts & graphs

I have a pitch deck, what do need to show in the projections slide?

Investors review countless proposals and you should assume they are spending minimal time on the Financials slide of your pitch deck. Keep things high-level and visual. You want to show potential for scale and growth in an easily digestible format. If an investor wants more detailed information, they will ask for it.

What about my Valuation, I need a DCF model don’t I?

Just don’t. Forget about the DCF (Discounted Cash Flow) model at early stages of a startup. Investors trust your rosy projections as much as they trust a weather man telling them what the weather will be next month in London.

There are three broad inputs that go into the valuation of every startup

- Detailed analysis: DCF, comparable method or precedents. DCF is the method of choice for evaluating later stage companies who have years of historical revenue and as such have more predictable cashflows. The comparable method simply values a startup based on the known valuation of other startups at a similar stage and characteristics.

- Tangibles: how big is the market? What is the probability of a large, multi-billion dollar exit? How big is the market today and how is the market likely to grow? What is the competitive landscape? How far along is the business – idea stage or already generating loads of revenue?

- Team: who are the founders and what is their background? Are they repeat founders with significant exists from previous businesses? Have they worked in big tech? Are they graduates of prestigious universities? Do they have money?

By far the greatest determinant of an early-stage startup’s valuation is the team. An investor basically considers the chances that the founding team are capable of delivering the returns that makes the valuation reasonable. Or more simply, the investors are just willing to pay whatever the founder says the company is worth.

It can be confusing figuring out what my cap table looks like with all the movements, can a financial model help?

Of course, it can be complex but we’re here to make your life easier.

Together with the pitch deck charts and use of funds (see below), the cap table analysis is one of the fundraising items we are automating on your startup dashboard on Caena.

Where do I find assumptions for my first financial model?

Assumptions are the building blocks for every financial model. For an established business with years of historical performance, putting together assumptions are straightforward. On the other hand, for early-stage founders pre-revenue, putting together assumptions for a first financial model can be overwhelming.

One thing to bear in mind as an early-stage founder, the assumptions are in your control. Even if you outsource the building of your model, you have to be in full control of the assumptions.

Your assumptions are key and will tell investors a lot about your understanding of your business. These can be top-down- starting from the market as a whole- or bottom-up, starting with your own business activities.

How do you know if your assumptions make sense? It’s all about disciplined storytelling. You want the story to be optimistic but still grounded in reality. And don’t forget to stay consistent with the rest of your pitch!

We have put together a detailed article on the assumptions required to build a first (simple) financial model, how to find those assumptions and how to ensure the assumptions are reasonable.

How do I get started? What do I need?

Remember, it’s all about keeping it simple. Think of the purpose of your financial model, decide which elements you need to achieve this (financial statements, metrics, charts/graphs) and then work towards it. You either DIY it or pay an expert to build your model.

Because of the perceived complexity of financial models, many founders default to engaging consultants to build their first financial model. This is fine if you can afford the £1,000 to £2,000 in costs and ~one month it takes PROVIDED the financial model meets the other two criteria we laid out earlier. However, 99% of the time, an expensive financial model will be too complex and you will not be confident presenting to investors.

Even for founders with years of investment banking experience, building financial models from scratch or Excel templates is time consuming. Caena’s automated financial modelling tool saves you loads of time and up to 90% of the cost of consultants so you can focus on what matters – growing your business.

In less than 30 minutes, you can generate metrics, charts and full projections for pitch decks, business plans and EIS/SEIS applications. In addition to financial modelling, we have also automated the investor prospecting process so you can identify investors most relevant to your business and most likely to invest in less than 5 minutes.