While I am not a founder (yet), I think my experience of building financial models as a fresh graduate with no financial know-how can be relatable to many of you.

A Daunting Task Ahead

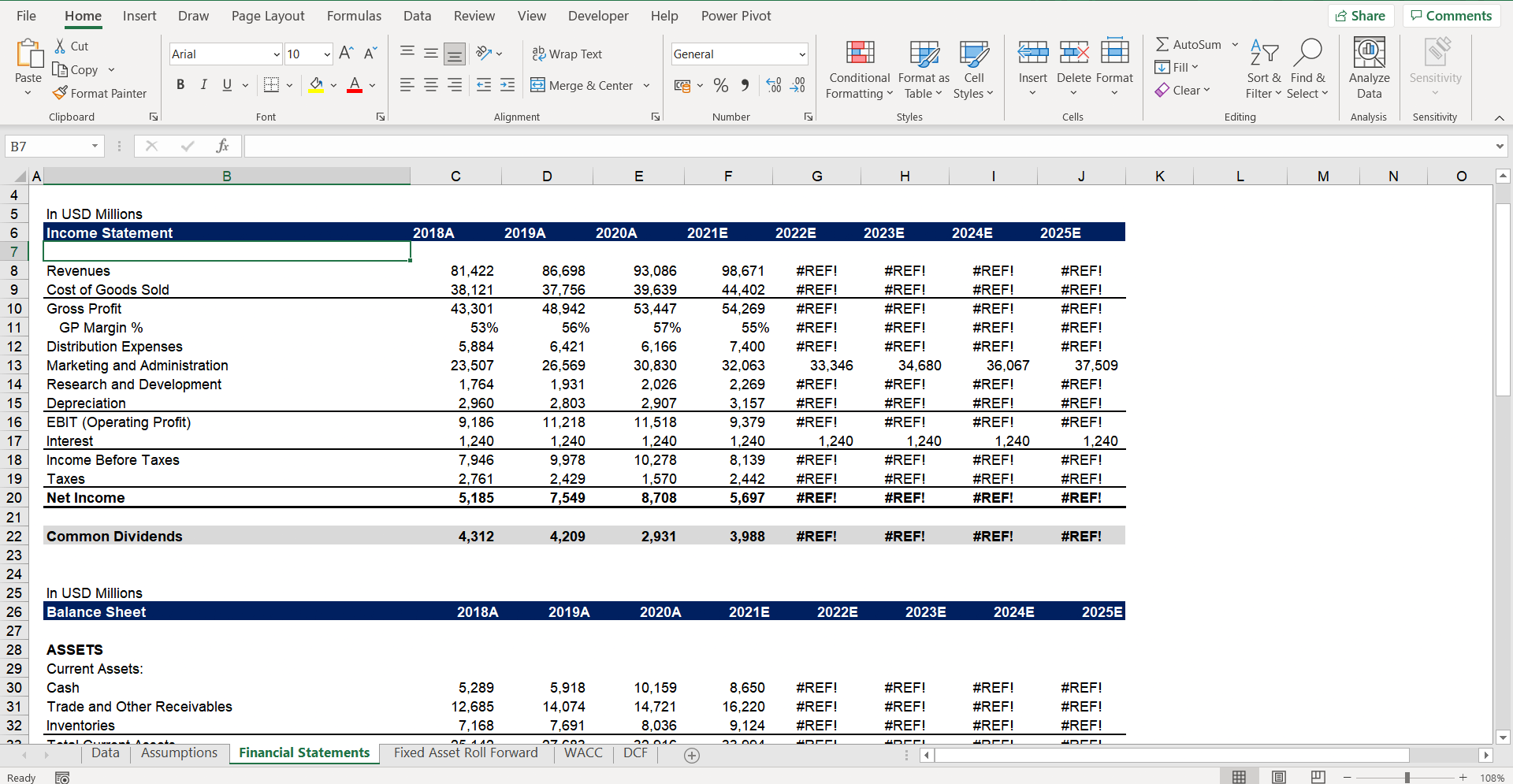

I first heard of the term financial modelling a little over a year ago when I started an internship with a stock brokering firm straight after graduating. I was assigned with a task of forecasting a 5-year projection for a company, based on its historical earnings and the current market outlook, in Excel.

For starters, I had no idea on how to create a projection, or what it even was. It was a completely new concept to me as I had very little knowledge in finance, investments, valuation and accounting. Fortunately for me, since I was an intern, my colleagues were happy to guide me through and took the time to explain the basics of financial modelling to me.

Since I had to run this projection in Excel, even though I knew a few basic commands, it was far from enough to help me forecast a model. This sent me scrolling through a number of YouTube videos on “How to build a financial model in Excel?”.

The biggest hurdle for me at the time was that I lacked a basic understanding of accounting, mainly on how the 3 financial statements were linked together and on how certain values were calculated. I also didn’t know the meanings of a lot of key financial metrics like the Weighted Average Cost of Capital (WACC), Enterprise Value (EV), Discounted Cash Flow (DCF) and the list went on… As a result, the task ahead of me seemed extremely daunting.

Financial Modelling Now Vs. Then

That was a year ago. Now however, when I look at where I am, compared to the knowledge I had a year ago, I can confidently say that I am able to quite easily manage to complete a valuation on a company using Excel. That said, completing such a valuation would definitely take me a minimum of at least 2 days given that I put all my time into the model (this is if I had to hardcode inputs, and built the model from scratch.)

For a founder, every minute is valuable and ideally should be used on growing the business, rather than mundane tasks, such as financial modelling. Also, most of them won’t have someone to guide them through building a model, as I was lucky enough to have.

How Caena Changed my View on Financial Modelling

I have been interning at Caena over the past two months and I was blown away when I first experienced what Caena could do and the difference it makes when it comes to financial modelling. This tool can generate a company’s future forecast, valuation and a discounted cash flow with all its metrics (such as equity and enterprise value) using a minimum of input; current year and historical values (if any).

Any individual with basically no knowledge in finance, Excel and accounting (like myself a few years ago) can generate a complete financial model of a business, given that they have the minimum inputs, in less than 30 minutes and without the use of dreaded spreadsheets! In addition, Caena will guide the user through the process, so they understand what they are doing and can confidently meet with investors.

In my view, this is a game changer, as the main pain point a person would have when forecasting a model usually is the fact that it is time consuming and/or they lack the know-how.

The past two months have opened my mind to what the team at Caena is working on. What I can say for now is that Caena is already well on their way on their journey to simplifying fundraising, and they are just getting started.