DCF is a No No! You Also Don’t Need to Pay Thousands to Advisors

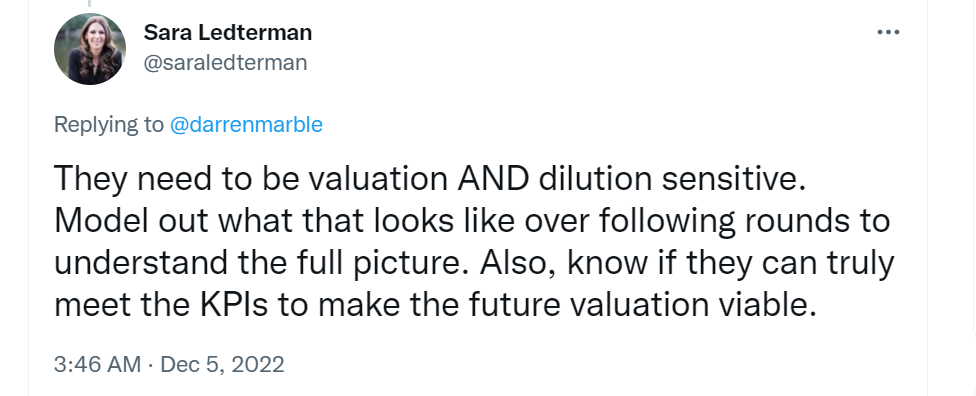

Valuation of early stage startups is a black box – like almost everything else in venture financing. Often from the very start of their startup journey, founders worry a lot about their valuation and for good reason. Set it too high and investors pass on participating in your round. Set your valuation too low and you suffer too much dilution.

On the other end of the spectrum, there’s also a risk of worrying TOO much about valuation. When I asked the tech world’s newest flashy tool ChatGPT “how do I value my early stage startup” its response was basically (i) use discounted cash flow analysis (DCF) and (ii) it’s so complex, get an advisor. We disagree on both points.

Humans – 1; Chat GPT — 0

For an early-stage startup (pre-seed to seed stage), a DCF is not at all an appropriate method for valuing the company. DCF analysis relies on critical assumptions such as future free cash flow, discount rate, terminal value and growth rates. For established companies, historical financial performance can be referred to as a baseline on which projections are made. Conversely, there is no baseline performance on which projections are made for early-stage startups. It’s all totally made up.

The value of a financial model to investors is scarcely the accuracy of the numbers (they are BS) but the thought process and rigour the founders have displayed in generating their financial projections.

Also, paying an advisor at this stage is unnecessarily complicating a simple exercise and a waste of money. Your valuation is basically a figure agreed between investor and founder. In rounds with a Lead Investor, the lead negotiates the term sheet and once agreed all other investors invest on the same terms. For angel / friends & family rounds without lead investors, the valuation conversation is repeated for each investor but gets easier once at least one investor has agreed to invest on the proposed terms.

Here are 5️⃣ steps to nailing your valuation relatively quickly and effortlessly

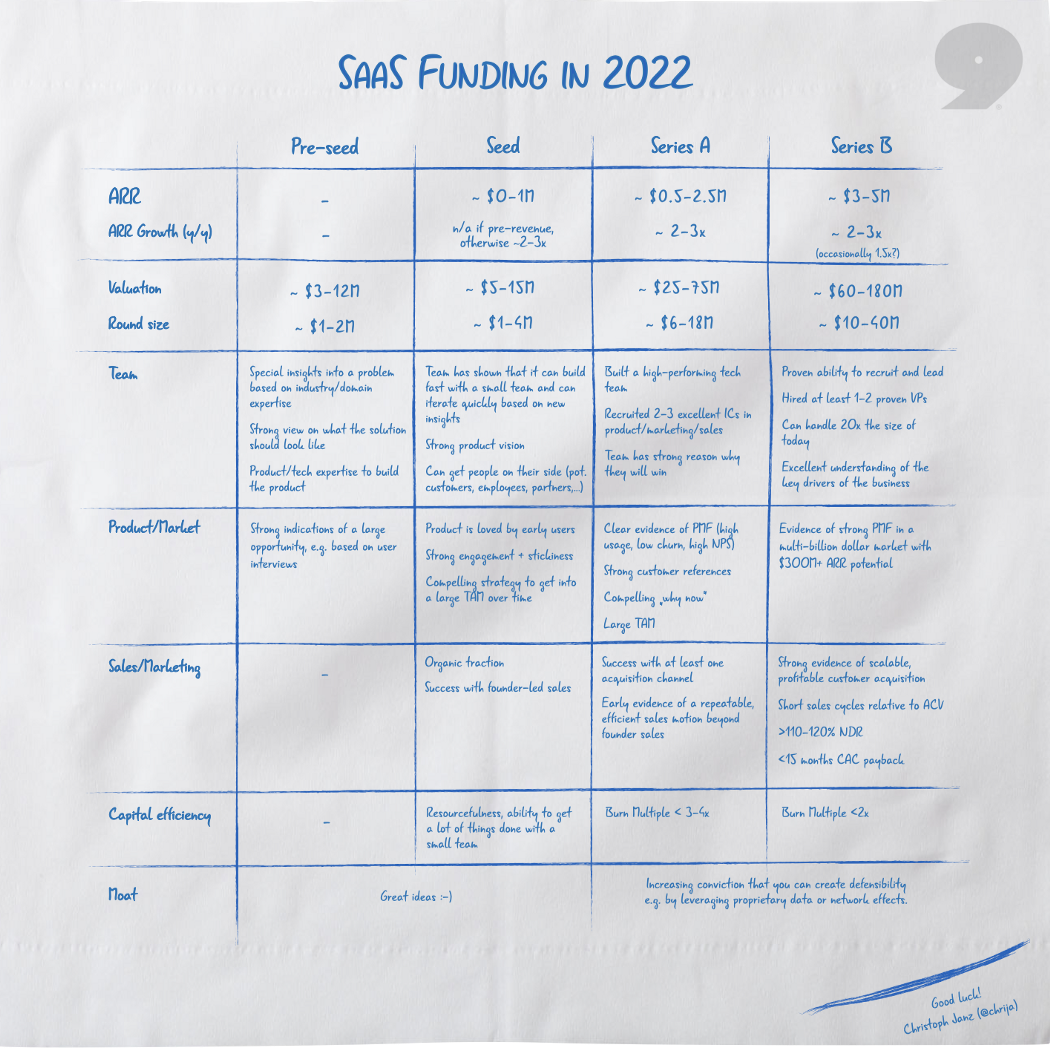

1. Estimate your funding needs

The first part of this step is identifying what your next milestone should be. For simplicity, this should be the metrics required to raise your next fundraising round. If you’re raising a Seed round for a SaaS startup, your funding should take you to ~$1 million ARR (annual recurring revenue) over the next 12–24 months. $1m ARR is considered good enough for Series A fundraise (among other metrics). Once you know what your metrics should be, then you figure out from your model what resources you need to achieve them.

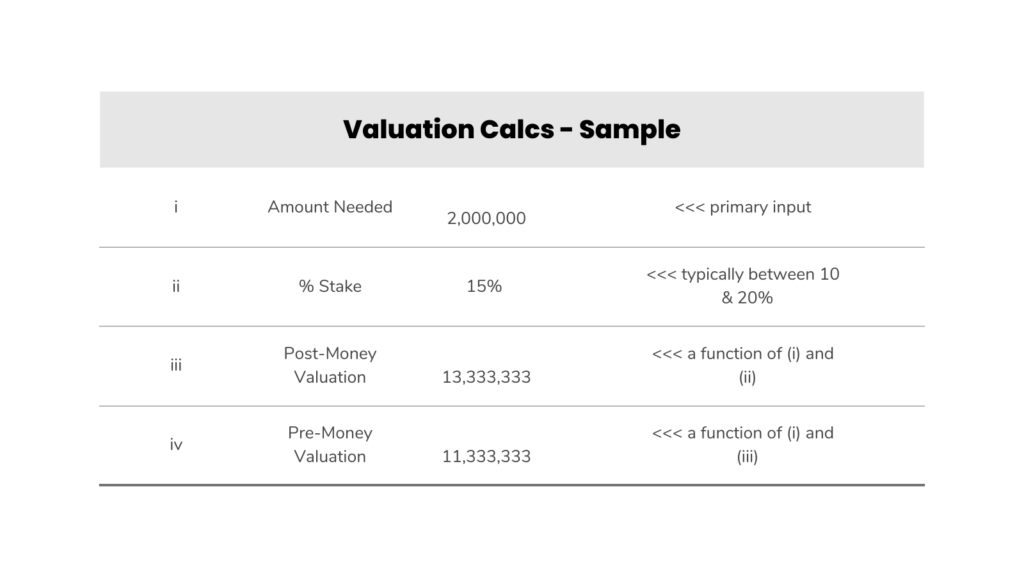

2. Decide on dilution

This step is relatively straightforward. Let’s say you decide you need $2 million to get you from where you are to Series A milestones. Most startup funding rounds involve dilution of ~10–20%. That is, you will be giving away this equity to investors in exchange for the funding. Any lower than 10% and its stingy to investors and any higher than 20% and founders risk owning inconsequential stakes if the startup ends up raising multiple rounds in the future. To emphasise, the dilution in early rounds has consequences far into the future. Your valuation is simply your funding amount divided by dilution.

There are two distinct valuation figures that are referred to in early-stage fundraising. There are no hard and fast rules over which is used and when. As such, it is important for founders to understand the distinction and implication of each.

- Pre-money valuation: this is the value of the startup BEFORE the fundraising round.

- Post-money valuation: this is the value of the startup AFTER the fundraising round is completed.

You can go from Pre- to calculate Post and vice versa.

3. Sense check your valuation based on comparable transactions (comps)

If you’re in a hurry feel free to skip straight to step 5. You’ve got the basics – how much $$$ you want and how much equity you’re offering for the $$$. . However steps 3 & 4 help improve the accuracy of your valuation thereby reducing the risk you’re under- or over- valued.

Most investors you speak to will be comparing your valuation with that of similar (comparable) startups at that point in time. So you should also conduct a sense check with recent comparable transactions similar companies. Due to the nature of private fundraising rounds, it’s often difficult to find full details of fundraising rounds. Often, funding announcements skew towards the large rounds and are made long after the actual funding has occurred. That said, the imperfect information is enough to make a rough estimate.

4. Take a haircut

Assuming the figure you arrived at in steps 1 and 4 are comparable then superb but there’s one small matter. The figures in step 4 are most likely from “in network” or “in-group” founders. Terms used to refer to elite, well sought after founders who raise relatively easily and at a much higher valuation than mere mortals. If you are not (i) a multiple founder with an exit > $10 million OR (ii) ex FAANG employee OR (iii) ivy league grad OR (iv) YC or other major alum then you need to take a more realistic approach.

5. Start the Fundraise

All the analysis ends here, it’s time to test the waters with your valuation. Speak with investors and adjust as you deem fit. Happy fundraising!

If you’re like most founders and struggle with financial modelling, then Caena is for you. In less than 30 minutes, you can generate metrics, charts and full projections for pitch decks, business plans and EIS/SEIS applications. In addition to financial modelling, you also get instant investor matching, so you can identify investors most relevant to your business. Get started for FREE.