“Building a Financial model is as painful as having a child” – Pre-Seed, Edtech Founder

If the idea of creating a financial model makes you nervous, you’re not alone. Founders tend to think of financial models in terms of complicated spreadsheets requiring a PhD in finance to understand. In reality, for early-stage, pre-revenue startups, it is really much simpler than some “experts” would like you to believe.

A very good financial model at the early stage should be simple, easy to understand and should not cost a fortune.

What is a financial model?

“Send me your projections….”

This simple request from an investor to an early-stage founder often causes mini-panic attacks. But answering it shouldn’t be nausea-inducing. There are three different elements of a financial model:

- Financial statements: Profit & Loss, Balance sheet and Cash Flow statements

- Metrics: Profitability, cash generation and growth indicators

- Charts & graphs

These can be used independently or combined. The trick is to know which to use for a particular audience or purpose.

Why do you need a financial model?

For two purposes: internal decision making and external-facing storytelling.

Many founders tend to prepare models only when fundraising. However, having one before even starting out is useful to ensure you build a sustainable business. Financial models are useful to understand business drivers & aid decision making.

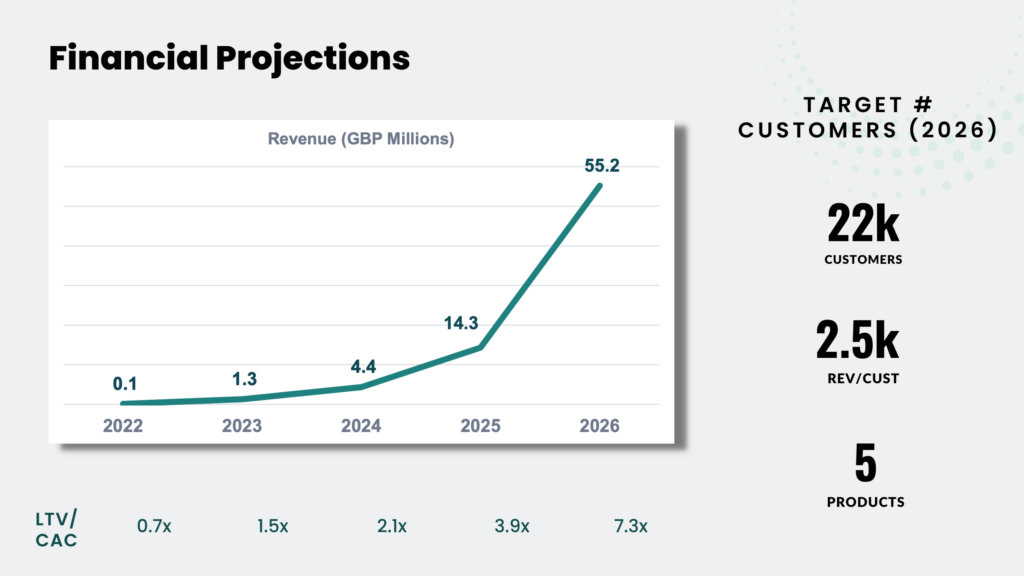

The common assumption is investors will deep-dive into the details. However, at an early-stage, models should be considered more as storytelling tools. Models should communicate a clear vision for your company and show investors that you understand the drivers behind your business. For fundraising, there are three related use cases: financial projections slides in pitch decks, cap table calculations and for estimating funding needs and valuation. Read more about these here.

Financial modelling for fundraising

The most common trigger for founders deciding to build financial models is when they start raising capital for the first time. If this is you, this is a structure I recommend you follow

- Identify your audience & the key message: yes you are fundraising but from who? This should be an easy answer if you have a proper fundraising strategy in place. The key thing here is this, are you raising from angel investors, VCs or other type of investors? Once you know that, the next question is, what is the ONE key message you want to pass to them? For instance, for VCs it’s all about returns so your pitch deck slide needs to communicate that you will meet the levels of returns they require.

- Situate your financial model within your overall story: one common mistake founders make is to create a financial model independent of the overall business plan. For instance, a founder projects “hockey stick” growth to over £100 million by year 5 in step 1 above. This sounds good but does the rest of your deck stack up and support this outcome?

- Gather your assumptions: this is arguable the heart of financial modelling – what are your assumptions and how do they (i) fit together and (ii) support your fundraising story? To get started, identify your key business drivers across the business and find relevant comparisons. For more details on building your financial modelling assumptions, see here.

How to build your first financial model

It’s all about simplicity, the strength of your assumptions and how consistent your model is with your overall business. First, decide on the purpose of your model and which elements you need. Then, you can either DIY it or pay an expert to build your model.

Many founders default to engaging consultants to build their first model. This is fine if you can afford the fees – up to £2,000- and the time it takes. But 99% of the time, the output will be overly complex and you will not be able to confidently present it to investors.

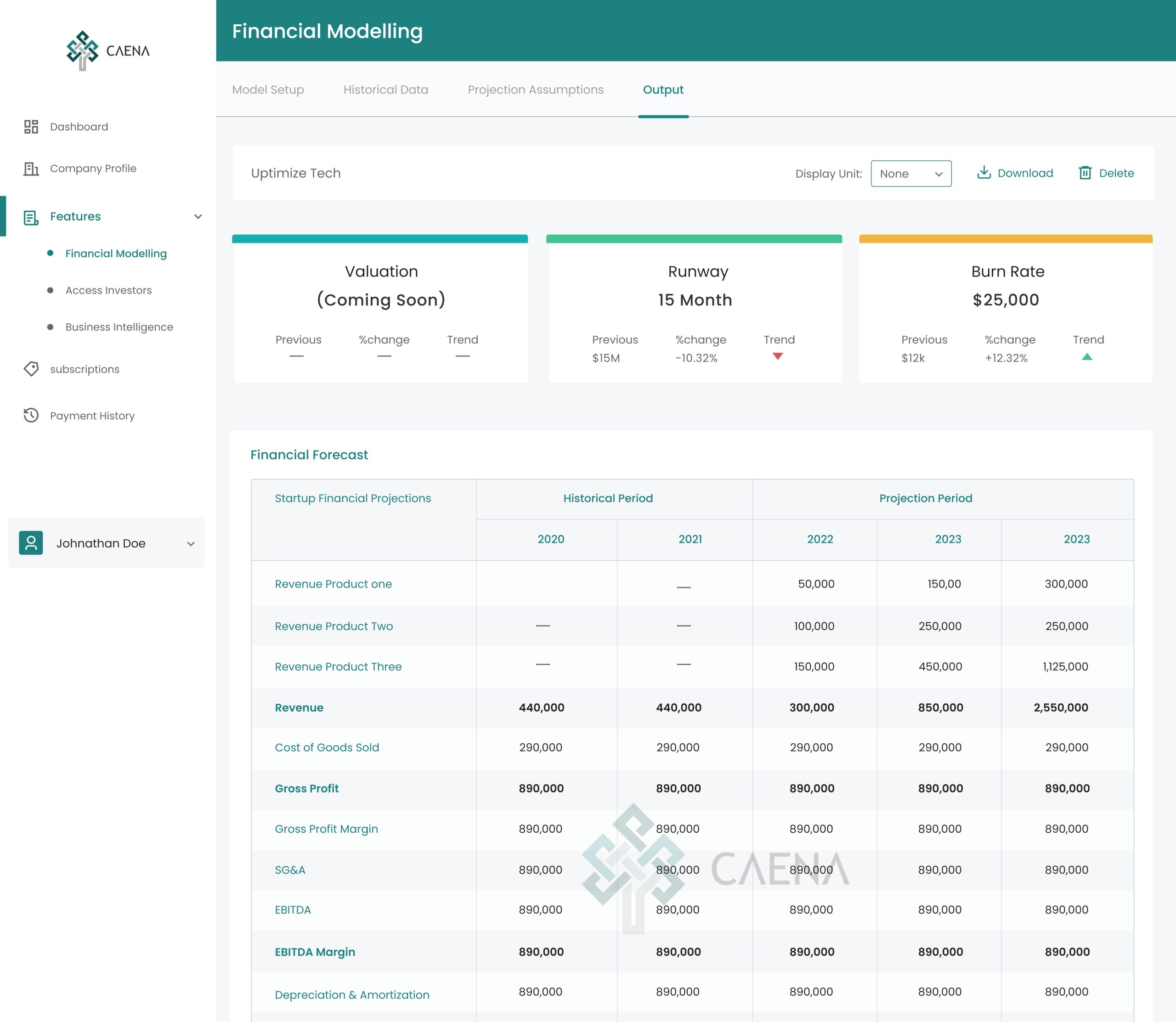

Even with a finance background, building models from scratch is time consuming. Caena’s automated financial modelling tool saves you loads of time and up to 90% of the cost of consultants so you can focus on what matters – growing your business.

In less than 30 minutes, you can generate metrics, charts and full projections for pitch decks, business plans and EIS/SEIS applications. In addition to financial modelling, you also get instant investor matching, so you can identify investors most relevant to your business. Visit Caena to get started for free.